Super curved trend session forecast [CLEVER]📊✨ Super curved trend 🔮

The Future of Trend Prediction, Visualized.

🔥Super curved trend session forecast is not just another trend indicator — it’s a high-precision forecasting system engineered to decode how long trends truly last, how strong they are, and when they are most likely to fade away.

Built using a fusion of Hull Moving Average (HMA), Curved Radius Supertrend, CLEVER Streak Analytics, this advanced Pine Script tool goes far beyond simple color changes — it analyzes, measures, and predicts market rhythm in real-time.

🧠 Core Concept:

Every market has a pulse — trends form, rise, and eventually die out.

The Trend Duration Forecast identifies the beginning of a new bullish 🟢 or bearish 🔴 phase, tracks its strength and slope, and then intelligently forecasts the probable continuation length ⏳ of that trend based on the historical average of previous movements.

When a new phase begins, the indicator automatically projects forward — showing how far the current trend can statistically go before exhaustion.

It also visually marks potential BUY 🟩 or SELL 🟥 zones with projected boundaries, helping traders anticipate not just what direction the market is going — but for how long.

OANDA:BTCUSD TVC:USOIL OANDA:XAUUSD OANDA:EURCHF

⚙️ Technical Architecture:

🧩 1. Hull Moving Average (HMA):

The heart of the system. It reacts faster than a standard MA but remains smooth enough to filter out false spikes. HMA’s slope determines the active trend phase and strength gradient.

🌀 2. Supertrend:

A next-gen enhancement to the classic Supertrend. Instead of linear lines, it uses curved ATR-based support and resistance paths that bend with price acceleration — giving you a dynamic visual flow of market structure and reducing whipsaws in volatile sessions.

📈 3. CLEVER Session

XAUUSD

USDCNH

GBPMXN

USDCHF

USOIL

EURUSD

DXY

BTCUSD

snapshot

Analytics:

Borrowed from high-end statistical modules, this tracks how many sessions have been consecutively bullish or bearish — revealing hidden rhythm patterns and market exhaustion points.

It also provides median, mode, and count streak data in a clean, optional dashboard overlay.

🎨 Visuals & Display:

✨ Color-coded candles change with trend state for instant clarity.

📊 Adaptive projection lines show trend duration zones and forecast targets.

🧾 A detailed Trend Duration Table lists the average length of past bullish/bearish runs, enabling data-backed decisions.

🔍 Smooth dynamic curvature ensures the chart looks clean yet highly responsive — ideal for both analysis and presentation.

💡 Practical Benefits:

✅ Forecast Continuation: Know how long your current trend is statistically likely to last before it weakens.

✅ Early Reversal Alerts: Identify when a new bullish or bearish phase is starting before the crowd.

✅ Smart Timing: Align your entries/exits with historical rhythm rather than random volatility.

✅ Visual Precision: Instantly recognize strength, direction, and duration from adaptive curves and color-coded visuals.

✅ Data-Driven Confidence: Trade with statistical context, not just visual cues.

🧭 Ideal For:

💥 Swing Traders – time your trades at the start of trend cycles.

⚡ Scalpers & Intraday Traders – catch short-term momentum while avoiding fake-outs.

🤖 Algorithmic Traders – integrate statistical forecasting into automated strategies.

📉 Market Analysts – visually present complex data in a digestible, story-driven way.

🧠 In Essences combines trend detection, duration prediction, and volatility curvature modeling into one seamless system.

It’s designed to make you see trends not just as lines — but as living patterns with measurable lifespans.

With this tool, you no longer trade reactively —

You trade intelligently, early, and with foresight. 🔥

🏁 Summary:

🔹 Advanced HMA-based trend detection

🔹 Dynamic Curved Radius Supertrend support/resistance

🔹 Statistical trend duration forecasting

🔹 CLEVER streak analytics module

🔹 BUY/SELL projection zones

🔹 Adaptive color-coded candles

🔹 On-chart dashboard + historical duration table

🚀 The future of precision trend analysis is Super curved trend session forecast —

See the trend. Measure its life. Predict its end. 🌙📈

Поиск скриптов по запросу "supertrend"

MB 3ST+EMA+StochRSI Martin Buecker 16.01.2025Short Description of the Indicator "MB 3ST+EMA+StochRSI Martin Buecker 16.01.2025"

This trend-following and momentum-based indicator combines Supertrend, EMA 200, and Stochastic RSI to generate buy and sell signals with improved accuracy.

1. Key Components

Supertrend (3 variations):

Uses three Supertrend indicators with different periods to confirm trend direction.

Buy signal when at least 2 Supertrends are bearish.

Sell signal when at least 2 Supertrends are bullish.

EMA 200 (Exponential Moving Average):

Buy signals only when the price is above EMA 200 (uptrend confirmation).

Sell signals only when the price is below EMA 200 (downtrend confirmation).

Multi-Timeframe Stochastic RSI:

Uses a higher timeframe Stoch RSI (default: 15 minutes) to filter signals.

Buy signal when %K crosses above %D (bullish momentum).

Sell signal when %K crosses below %D (bearish momentum).

2. Signal Generation

📈 Buy Signal Conditions:

✅ At least 2 of 3 Supertrends are bearish

✅ Price is above EMA 200

✅ Stoch RSI shows a bullish crossover (%K > %D)

📉 Sell Signal Conditions:

✅ At least 2 of 3 Supertrends are bullish

✅ Price is below EMA 200

✅ Stoch RSI shows a bearish crossover (%K < %D)

3. Visual Representation & Alerts

Supertrend Lines:

Green = Bullish, Red = Bearish

EMA 200: White Line

Buy/Sell Signals:

Green triangle (below bar) = Buy

Red triangle (above bar) = Sell

Alerts:

Notifies users when a buy or sell signal is triggered.

Background Coloring:

Green for Buy signals, Red for Sell signals

4. Purpose & Benefits

🔥 Combines trend (EMA 200, Supertrend) and momentum analysis (Stoch RSI) for better signal accuracy.

🔥 Works best in trending markets, filtering out false signals in sideways movements.

🔥 Suitable for scalping and day trading, providing clear and structured trade entries.

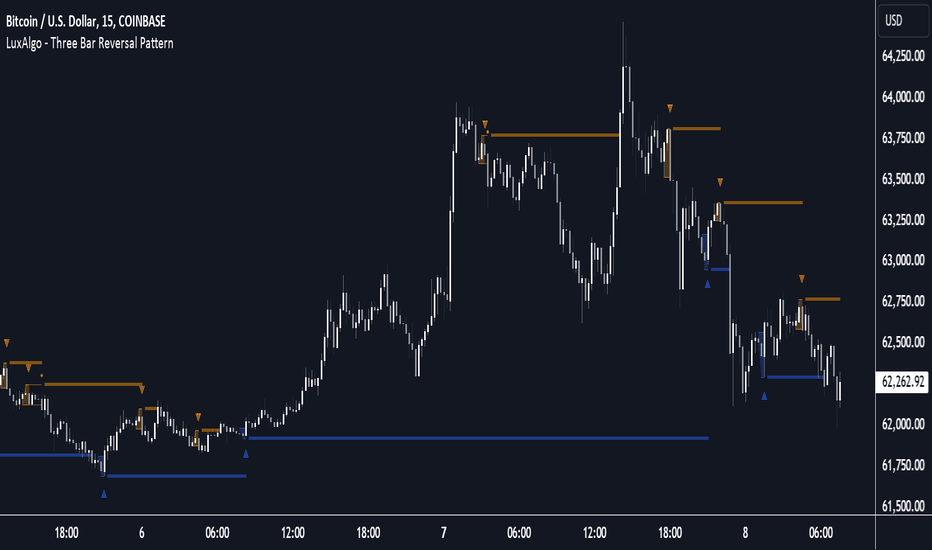

Three Bar Reversal Pattern [LuxAlgo]The Three Bar Reversal Pattern indicator identifies and highlights three bar reversal patterns on the user price chart.

The script also provides an option for incorporating various trend indicators used to filter out detected signals, allowing them to enhance their accuracy and help obtain a more comprehensive analysis.

🔶 USAGE

The script automates the detection of three-bar reversal patterns and provides a clear, visually identifiable signal for potential trend reversals.

When a reversal chart pattern is confirmed and price action aligns with the pattern, the pattern's boundaries are extended, forming levels, with the upper boundary often acting as a resistance and the lower boundary as a support.

The script allows users to filter patterns based on a specific trend direction detected by multiple trend indicators. Users can choose to view patterns that are either aligned with the detected trend or opposite to it.

Included trend indicators are: Moving Average Cloud, Supertrend, and Donchian Channels.

🔶 DETAILS

The three-bar reversal pattern is a technical analysis pattern that signals a potential reversal in the prevailing trend. The pattern consists of three consecutive bar formations:

First Bar and Second Bar: 2 consecutive of the same sentiment, representing the prevailing trend in the market.

Third Bar: Confirms the reversal by closing beyond the high or low of the first bar, signaling a potential change in market sentiment.

Various types of three-bar reversal patterns are documented. The script supports two main types:

Normal Pattern: Detects three-bar reversal patterns without requiring the third bar closing price to surpass the high (bullish pattern) or low (bearish pattern) of the first bar. It identifies basic formations signaling potential trend reversals.

Enhanced Pattern: Specifically identifies three-bar reversal patterns where the third bar closing price surpasses the high (bullish pattern) or low (bearish pattern) of the first bar. This type provides a more selective signal for stronger trend reversals.

🔶 SETTINGS

Pattern Type: Users can choose the type of 3-bar reversal patterns to detect: Normal, Enhanced, or All. "Normal" detects patterns that do not necessarily surpass the high/low of the first bar. "Enhanced" detects patterns where the third bar surpasses the high/low of the first bar. "All" detects both Normal and Enhanced patterns.

Derived Support and Resistance: Toggles the visibility of the support and resistance levels/zones.

🔹 Trend Filtering

Filtering: Allows users to filter patterns based on the trend indicators: Moving Average Cloud, Supertrend, and Donchian Channels. The "Aligned" option only detects patterns that align with the trend and conversely, the "Opposite" option detects patterns that go against the trend.

🔹 Trend Indicator Settings

Moving Average Cloud: Allows traders to choose the type of moving averages (SMA, EMA, HMA, etc.) and set the lengths for fast and slow-moving averages.

Supertrend: Options to set the ATR length and factor for Supertrend.

Donchian Channels: Option to set the length for the channel calculation.

🔶 RELATED SCRIPTS

Reversal-Candlestick-Structure .

Reversal-Signals .

[ADOL_]EasyTradingENG) EasyTrading Indicator(ET)

Introduce)

This is the result of long research and trial and error. This indicator is an indicator that marks the signal on the chart.

Short-term, mid-term, and long-term points are analyzed, and signals leading to long-term trends are marked with a background color.

Indicates oversold and overbought, and modified Ichimoku equilibrium. Indicates the criteria for the new TD.

It is the latest version of the signal indicator that complements the limitations of existing indicators.

Noise cancellation is the key to overcoming limitations.

Alerts are included in the signal notation, allowing integration with bots that utilize alerts.

So that even beginners can use it easily, we exclude miscellaneous functions and focus only on whether it is long or short.

principle)

Principle of Moving Average: Various moving averages (SMA, EMA, WMA, HMA, RMA, SWMA, VWMA) can be used. Simply using only moving averages cannot overcome the existing problems.

The problems that arise from existing signal indicators include structural problems in which entry and exit do not appear properly due to lagging and delay of indicators, and frequent overuse of RBIs.

In order to compensate for these limitations, BNF's disparate rate trading method was referred to. I did not use the existing moving average as it is, but I optimized the formula by reflecting my experience, so the existing moving average

It is characterized by the fact that it cannot be implemented according to the signal of the indicator.

The principle of oversold and overbought: implemented using RSI.

Short-term signal: The principle of the TD indicator has been utilized and modified. The setup principle of the TD indicator,

which compares the current candlestick and the four previous candlesticks and indicates numbers from 1 to 9, was modified by applying it to the moving average.

Intermediate Signal: Moving averages and Ichimoku balance have been modified. We applied the breakthrough of clouds (positive and negative) created in Ichimok balance.

Long-term signal: The principle of moving averages was used.

comparison with existing indicators)

Compared to Supertrends:

The top is the ET indicator, and the bottom is the supertrend indicator. Supertrend is set to 14,3, which is commonly used.

Looking at the background color representing the long-term signal of ET while the super trend repeatedly displays buy and sell and sees loss of intervals

ET does not see section loss as no signal appears in the middle after one entry.

The same goes for other sports.

Compared to the moving average (sma):

Even when compared to the golden cross and dead cross conditions that break through the moving average line, the moving average line accumulates losses due to frequent entries and exits in the section that moves sideways.

ET, which compensates for the limitations, continues the trend without noise.

Comparison with Ichimoku:

ET has less noise than entering a trade using Ichimoku's red cloud and green cloud.

Necessity)

In order to work with the bot, the key is to accurately implement the hitting point and remove noise. It is a basic approach to trading even if it is not linked to a bot.

In the setting of most indicators, if you increase the period, you can see the long-term trend, but the entry point is delayed, and if you decrease the period, the entry point becomes frequent and enters a place where you shouldn't enter.

ET catches the entry point and noise removal, and helps you approach the entry point correctly even if you don't trade often.

Catching the two rabbits was the most difficult. how many years...

chart)

Notation of background color:

Long-term signals are displayed in the background color so that trends can be grasped at a glance.

Long term signal:

It is indicated by an arrow on the chart.

Mid term signal:

The decline is indicated by a black gradient on the candle and a red circle above the candle.

The rise is indicated by a white gradient on the candle and a green circle below the candle.

short-term signal:

On the chart, the candlesticks are numbered from 1 to 9.

Oversold/Overbought:

Oversold conditions are indicated by yellow diamonds (◆).

Overbought is indicated by a blue diamond (◆).

Determine the TP on the first oversold or overbought bar. Split profit start.

timeframes and alerts)

It can be applied to all time frames, and the standard time at the center is 1h.

You can adjust the dot while viewing the 15-minute bar and the 1-hour bar together.

multi time frame. It is recommended to observe multiple times at the same time using the split screen.

Note)

This indicator is not a guarantee of absolute returns, and you are solely responsible for any trading decisions you make.

How to use)

It is set to be used by invited users only.

If you receive an invitation, tap Add indicator to favorites at the bottom of the indicator.

If you go to the chart screen and press the indicator at the top, there is a Favorites tab on the left tab.

Add an indicator by clicking on the indicator name in the Favorites tab (or Invite Only).

If a study error occurs when adding an indicator even though permission has been granted

You may be able to fix the problem by turning off all charts and restarting.

KOR) EasyTrading 지표(ET)

소개)

이것은 오랜 연구와 시행착오의 결과물입니다. 해당 지표는 차트에 시그널을 표기해주는 지표입니다.

단기, 중기, 장기 타점을 분석하며, 장기트렌드를 이끄는 시그널은 배경색으로 표기됩니다.

과매도와 과매수를 표시하며, 변형된 일목균형을 표시합니다. 새로운 TD의 기준을 표시합니다.

기존의 지표들이 가지는 한계를 보완한 시그널 지표의 가장 최신 버전입니다.

한계를 극복하는데는 노이즈 제거가 핵심이라고 볼 수 있습니다.

시그널 표기에는 얼러트가 포함되어, 얼러트를 활용하는 봇과 연동이 가능합니다.

초보자도 쉽게 활용할 수 있도록 잡다한 기능은 빼고, 롱이냐 숏이냐에만 집중합니다.

원리)

이동평균선의 원리 : 여러가지 이동평균선(SMA, EMA, WMA, HMA, RMA, SWMA, VWMA) 을 활용할 수 있습니다. 단순히 이동평균선만 활용하는 것으로는 기존의 문제점을 뛰어넘을 수 없습니다.

기존의 시그널 지표에서 발생하는 문제점은, 기본적으로 지표가 가지는 후행성과 지연으로 인해, 진입과 청산의 자리가 제대로 나오지 않는 구조적인 문제, 잦은 타점 남발 등이 있습니다.

이러한 한계를 보완하기 위해서 BNF의 괴리율 매매법을 참고하였습니다. 기존의 이평선을 그대로 쓰는 것이 아니라 저의 경험을 반영해 수식을 최적화하였기 때문에 기존의 이평선으로는

해당 지표의 시그널을 따라 구현할 수 없다는 것이 특징입니다.

과매도, 과매수의 원리 : RSI를 활용하여 구현하였습니다.

단기시그널 : TD 지표의 원리를 활용 및 변형하였습니다. 현재 캔들과 4개이전의 캔들을 비교해 1~9까지 숫자로 표기하는 TD 지표의 setup 원리를 이평선에 적용하여 변형하였습니다.

중기시그널 : 이평선 및 일목균형을 변형하였습니다. 일목균형에서 만들어지는 구름(양운과 음운)의 돌파를 응용하였습니다.

장기시그널 : 이평선의 원리를 활용하였습니다.

기존의 지표들과 비교)

슈퍼트렌드와 비교 :

상단은 ET지표, 하단은 슈퍼트렌드 지표입니다. 슈퍼트렌드는 일반적으로 많이 쓰는 14,3 으로 세팅하였습니다.

슈퍼트렌드가 buy와 sell을 반복적으로 띄우며 구간손실을 보는동안, ET의 장기시그널을 나타내는 배경색을 보면

ET는 한번의 진입후 중간에 시그널이 출현하지 않으면서 구간손실을 보지 않고 있습니다.

다른 종목에서도 마찬가지입니다.

이동평균선(sma)과 비교 :

이동평균선을 돌파하는 골든크로스와 데드크로스 조건과 비교해도 횡보하는 구간에서 이동평균선은 잦은 진입과 청산으로 손실을 누적하지만

한계를 보완한 ET는 노이즈 없이 추세를 이어나갑니다.

일목균형과 비교 :

일목균형의 양운과 음운을 활용하여 타점을 진입하는 것보다 노이즈가 적습니다.

필요성)

봇과 연동하기 위해서는 타점을 정확하게 구현하는 것과 노이즈의 제거가 핵심입니다. 봇과 연동하지 않더라도 매매의 기본적인 접근입니다.

대부분의 지표의 설정에서 기간을 늘리면 장기추세를 볼 수 있으나 진입점이 늦어지고, 기간을 줄이면 진입점이 잦아 들어가지 말아야 할 곳에 들어가게 됩니다.

ET는 진입점과 노이즈 제거 두마리 토끼를 잡아, 자주 매매하지 않더라도 바르게 진입점에 접근할 수 있도록 도와줍니다.

두마리 토끼를 잡는 것이 가장 어려웠습니다. 몇년의 시간..

차트로 설명)

배경색의 표기 :

장기시그널을 배경색으로 표기하여 트렌드를 한눈에 파악할 수 있도록 하였습니다.

장기시그널 :

차트상에서 화살표로 표기됩니다.

중기 시그널 :

하락은 캔들의 검정색 그라데이션과 캔들 위 빨간색 원으로 표시됩니다.

상승은 캔들의 하얀색 그라데이션과 캔들 아래 초록색 원으로 표시됩니다.

단기시그널 :

차트상에서 캔들에 1~9까지 숫자로 표시됩니다.

과매도/과매수 :

과매도는 노란색 다이아몬드(◆)로 표시됩니다.

과매수는 파란색 다이아몬드(◆)로 표시됩니다.

과매도, 과매수가 처음 발생하는 봉에서 TP를 결정합니다. 분할익절 시작.

타임프레임 및 얼러트)

모든 시간프레임에 적용 가능하며, 중심이 되는 기준시간은 1h 입니다.

15분봉과 1시간봉을 같이 보면서 타점을 조절할 수 있습니다.

멀티타임프레임. 화면분할을 활용하여 여러 시간을 동시에 관찰하는 것을 추천합니다.

참고사항)

해당지표는 절대수익을 보장하는 지표가 아니며, 귀하가 내리는 모든 거래 결정은 전적으로 귀하의 책임입니다.

사용방법 )

초대된 사용자만 사용할 수 있도록 설정이 되어있습니다.

초대를 받을 경우, 지표 하단의 즐겨찾기에 인디케이터 넣기를 누릅니다.

차트화면으로가서 상단에 지표를 눌러 왼쪽탭에 보면 즐겨찾기 탭이 있습니다.

즐겨찾기 탭 (또는, 인바이트 온리) 에서 지표이름을 눌러서 지표를 추가합니다.

권한이 부여됐음에도 지표추가시 study error가 발생할 경우

차트를 모두 끄고 재시작함으로써 문제점을 해결할 수 있습니다.

Dammu AI PROType & Purpose

Multi-functional trend, swing, and smart money concept indicator.

Combines SuperTrend, SMA, ATR-based risk management, swing structures, order blocks, EQH/EQL, and Fair Value Gaps (FVG).

Designed for identifying trends, entries/exits, and support/resistance zones.

2. Trend Detection

SuperTrend with ATR smoothing (nsensitivity*7 factor) for buy/sell signals.

SMA filter (8 & 9 periods) confirms trend strength.

Bar color changes:

Green if close > supertrend.

Red if close < supertrend.

Cirrus Cloud highlights trend zones with semi-transparent colors.

3. Swing & Structure

Detects pivot highs/lows and labels them as HH/LH (Highs), HL/LL (Lows).

Generates BOS (Break of Structure) and CHoCH (Change of Character) signals.

Internal swing structures and order blocks for short-term intraday moves.

4. Order Blocks

Internal Order Blocks (iOBs) and Swing Order Blocks (OBs).

Boxes drawn for bullish/bearish zones.

Auto-delete when broken.

Option to filter blocks by ATR or Cumulative Mean Range.

5. Risk Management

TP/SL levels based on ATR and user-defined % risk.

Shows lines and labels for:

Entry

Stop Loss

TP1, TP2, TP3

Adjustable line style (solid/dashed/dotted).

6. Fair Value Gaps (FVG)

Highlights bullish and bearish gaps.

Option for auto-threshold filtering.

Extendable FVG boxes.

7. EQH/EQL

Detects Equal Highs (EQH) and Equal Lows (EQL) for potential reversals.

Dotted lines with labels.

8. Smart Money Concepts (SMC) Features

Shows:

Swings (internal & swing structure)

Internal order blocks

Premium/Discount zones

Fair Value Gaps

Highs/Lows from previous day/week/month

Configurable for historical vs present display.

9. Alerts

Buy/Sell triggers:

bull = crossover of close above SuperTrend.

bear = crossunder of close below SuperTrend.

Alerts for BOS/CHoCH, EQH/EQL, and OB breaks.

10. Visualization

Trend clouds, colored bars, SMA markers, SuperTrend labels.

Multi-layered info displayed without cluttering the chart.

Customizable colors, line styles, and transparency.

✅ Summary:

This indicator is a comprehensive trading tool for trend detection, swing structure, order block analysis, and risk management. It’s built for smart money and SMC-based trading, offering visual cues and alerts for key trading decisions.

Trend Direction & Levels IdentifierOverview : Trend Direction & Levels Identifier (TDLI) provides you with two lines - Resistance/Support line (RSLine) and Trend Line. These two lines form a channel which is filled with a colour showing current market direction, which also prints Bullish or Bearish text. Trend Line calculation is similar but follows different approach than Super Trend indicator. RSLine calculation is done using EMA and dynamic ATR.

How does this work?

Firstly understand Supertrend - The Supertrend indicator is a freely available technical analysis tool that helps traders identify the direction of the trend . It is based on the concept of volatility, and it provides a simple way to identify whether the current market trend is bullish or bearish.

Here's a basic explanation of the Supertrend indicator's logic and how it is commonly used:

Supertrend Indicator Logic:

Calculation of Average True Range (ATR) : The first step involves calculating the Average True Range (ATR) over a specified period. ATR measures market volatility by considering the average range between the high and low prices over a given number of periods.

Multiplier Factor : A multiplier factor is then applied to the ATR. The multiplier is usually set by the trader or analyst and determines the sensitivity of the Supertrend to changes in volatility.

Calculation of Upper and Lower Bands:The Supertrend indicator calculates two bands - an upper band and a lower band.

Upper Band (UB) = High price - (Multiplier * ATR)

Lower Band (LB) = Low price + (Multiplier * ATR)

Determining Trend Direction : If the current market price is above the Upper Band, the Supertrend suggests a bearish trend (sell signal). If the current market price is below the Lower Band, the Supertrend suggests a bullish trend (buy signal).

Now, Let's understand how we use this logic with some modification to build our Trend line -

Let's break down the key differences:

1. Calculation of Trend Switch Points:

- Supertrend: The Supertrend indicator primarily relies on the Average True Range (ATR) to calculate the volatility of the market. It then determines trend direction based on whether the closing price is above or below the Supertrend line.

- Our Trend: We use a modified ATR for volatility measurement (ATR / x), our code introduces modifications in the calculation of trend switch points. It incorporates moving averages (SMA - Simple Moving Averages) to define high and low prices, adding a dynamic element to the identification of trend reversal points.

2. Trend States and Switch Logic:

- Supertrend: The Supertrend generally has two states: uptrend or downtrend. It switches its state when the closing price crosses the Supertrend line.

- Our Trend: Our code introduces an additional variable, which is not binary (0 or 1) but rather represents the state of the trend (0 for uptrend, 1 for downtrend). The indicator uses a more complex logic involving previous trend states and moving averages to determine trend switches.

So, our trend line incorporates additional elements such as moving averages, dynamic amplitude, and channel deviation to modify the Supertrend logic and provide a more nuanced and visually informative representation of market trends. These modifications offer traders more flexibility in adapting the indicator to different market conditions and trading preferences.

Remember the underlying logic is of Supertrend which is freely available to all.

Another line is RSLine, lets dive into its logic and calculation -

Average True Range (ATR) Calculation : Calculates the Average True Range, a measure of market volatility. The ATR can be dynamically adjusted based on user preference.

Chande Momentum Oscillator (CMO) and Variable (VAR) Calculation : Calculates the CMO, which measures momentum, and uses it to compute the VAR value. This introduces an adaptive element to the indicator.

Other Moving Averages : Calculates various moving averages, including Wilder's Moving Average (WWMA), Zero-Lag Exponential Moving Average (ZLEMA), and Time Series Forecast (TSF), providing different perspectives on trend direction.

Main Moving Average (MAvg) Calculation : Computes the main moving average based on EMA and length.

Stop Level Calculation : Determines stop levels for both long and short positions. The levels are influenced by the moving average (MAvg) and ATR, with an option to normalize them.

The Stop Levels forms the RSLine which acts as either resistance or support based on market direction.

Lets see how the indicator tells you probable market direction -

Direction Identification : Identifies the current trend direction (uptrend or downtrend) based on the relationship between the moving average and the previous stop level. It also prints Bullish or Bearish on chart based on crossovers and crossunders between the Trend Line and the RSLine.

Fill Coloring for Highlighting : It Fills the area between the Trend Line and RSLine with either green or red color to visually emphasize the trend direction. The colors change based on whether the Trend Line and MAvg is above or below the stop levels.

So there are 3 major things -

1. RSLine - Uses EMA and dynamic ATR to calculate stop levels. This acts as support or resistance to current trend. It is always red in colour.

2. Trend Line - Unlike Super Trend this Trend Line calculation uses a combination of highest high, lowest low, and EMA of a fixed range of candles to determine trend changes. It uses a fixed amplitude for calculating the highest high, lowest low, and EMA values, but it doesn't incorporate dynamic volatility adjustments like ATR. Its colour varies from red to green based on calculation.

3. Channel Colour - Channel colour is decided based on crossover of Trend Line and RSLine, if Trend Line crosses RSLine from bottom then channel colour becomes green, similarly red colour is calculated.

How to use this?

Refer this snapshot for content below -

1. Once a crossover happens between Trend Line and RSLine, bullish / bearish text is printed with change in colour of channel. RSLine acts as support/resistance.

2. Look for colour of Trend Line - when it matches channel colour, it means favourable direction is that colour (green - long, red - short)

3. Remember any ongoing trend can reverse any second, so follow price action for better results.

Preferred Timeframe : It works best in 5 minute timeframe, but can also be used in other time frames.

Reason to use these two lines ?

The Trend Line tells current trend direction using a line which keeps changing colours, for double confirmation we use the RSline and channel colour which is calculated using Trend line and RSLine crossover. When both Trend line and RSLine channel colour is same that gives a more solid confirmation (not 100%) of a trend

Why it is worth paying for :

As mentioned earlier this indicator is built over freely available Supertrend and EMA indicators. The modifications which we have done for better calculation and visualisation makes it worth.

The indicator may be considered valuable for traders who appreciate a visual representation of market trend direction and important stop levels. Normal indicators like supertrend just shows a line which gives you idea about the trend but our indicator apart from telling trend direction tells important levels and provide a channel filled with current trend direction significance which helps in following trend precisely.

1. The customization options and visual clarity could enhance decision-making for those who prefer a more tailored approach.

2. Traders willing to pay for this indicator may find it useful in complementing their existing analysis and strategy.

Although one should understand using premium indicator doesnt mean it will generate magic results, if you know price action and risk management properly then only consider trying our indicator else practice trading on free indicators first.

IMPORTANT : As Stock markets are dynamic in nature, no indicator is a magic indicator which will give you 100% accurate results on one click. You still have to use price action for best results.

DISCLAIMER : This indicator isn't a get rich quick scheme, neither it can provide 100% accurate results. It is meant to be used as an aid to Price Action Trading and proper risk management.

Dammu AI ADVANCED PRO1. Indicator Overview

Name: Dammu

Type: Overlay indicator (draws on price chart)

Purpose: Combines SuperTrend, SMA/EMA trends, Swing/Structure analysis, Order Blocks, Fair Value Gaps, High/Low levels, TP/SL labels, and alerts.

Pine Script Version: v5

2. SuperTrend Module

Computes SuperTrend line using ATR and sensitivity.

Signals:

Bullish: Price crosses above SuperTrend.

Bearish: Price crosses below SuperTrend.

Plots buy/sell labels 🚀🐻 based on SMA comparison and SuperTrend cross.

3. SMA/EMA Trend Components

SMA8 & SMA9: Used for additional trend confirmation.

EMA lines: Multiple EMAs with different multipliers for trend detection.

Trend Cloud: Uses Hull MA for trend smoothing.

4. Risk Management

TP/SL Levels: Automatic calculation of stop-loss and take-profit (TP1, TP2, TP3).

Configurable ATR-based risk percentage.

Lines and labels drawn for visual TP/SL.

5. Chart Features

Smooth Range Filter: Filters noise for trend detection.

Colored Trend Cloud: Upward trend = cyan, downward = red.

Sideways Market: ADX filter to color bars purple if trend is weak/sideways.

Bar Colors: Green/red based on SuperTrend signals.

6. Swing & Structure Analysis

Detects Swing Highs/Lows, labels as HH, LH, LL, HL.

Detects CHoCH (Change of Character) or BOS (Break of Structure).

Can show internal or swing structures with configurable label size and color.

7. Order Blocks (Smart Money Concepts)

Detects Internal Order Blocks (iOB) and Swing Order Blocks (OB).

Stores top/bottom/left/time/type in arrays.

Colors and shows boxes based on bullish/bearish type.

Automatically deletes OB if price breaks the block.

8. Fair Value Gaps (FVG)

Identifies gaps between candles as potential trading zones.

Configurable bullish/bearish colors and extension bars.

9. EQH/EQL (Equal Highs/Lows)

Detects equal highs/lows using a threshold.

Plots dotted lines and labels EQH/EQL.

10. High/Low Levels MTF

Optional plotting of previous daily, weekly, monthly highs/lows.

11. Premium/Discount Zones

Plots Premium, Discount, and Equilibrium Zones.

Colors: Premium = red, Discount = green, Equilibrium = gray.

12. Alerts

Buy/Sell alerts for:

SuperTrend crossover

BOS/CHoCH (swing/internal)

EQH/EQL triggers

13. Miscellaneous

Configurable visuals: line style, label size, transparency.

Adjustable volatility filters, ATR lengths, smoothing constants.

Integrated risk & reward visualization.

✅ In short:

This is an all-in-one Smart Money + Trend indicator with SuperTrend signals, swing/structure detection, order blocks, FVGs, EQH/EQL, TP/SL visualization, and optional alerts. It’s designed for both trend-following and order-block-based trading.

If you want, I can make a super-short 1-paragraph version that summarizes it even faster for quick reference.

Trend, Momentum and Price value analysis [deepakks444]Trend, Momentum, and Price Value Analysis

This indicator combines several key technical analysis tools to help traders evaluate the market's trend strength, momentum, and overall price behavior. It uses a variety of signals to generate a "Buy," "Sell," or "No Clear Indication" based on multiple indicators and plots them directly on the chart. A customizable table also summarizes these signals, making it easy to interpret the market conditions in real-time.

Key Features:

VWAP (Volume-Weighted Average Price): Indicates whether the price is above or below the VWAP line, helping to identify buying or selling opportunities based on fair value.

Alligator Indicator: Utilizes three simple moving averages (SMAs) to track trend direction, providing a clear "Buy" or "Sell" signal when the averages are aligned.

Supertrend: A widely-used trend-following indicator, this script identifies potential buy or sell zones based on the price's relationship with the Supertrend line.

20-period Moving Average (MA): A simple moving average to track the overall trend direction. The signal is based on the price crossing above or below the MA.

ADX (Average Directional Index): Measures the strength of the trend. A reading above 25 indicates a "Buy" signal, while a reading below suggests a "Sell."

RSI (Relative Strength Index): Generates a buy signal when RSI exceeds 60 and a sell signal when it drops below 40. Values between 40 and 60 indicate a neutral condition.

MACD (Moving Average Convergence Divergence): Provides a signal for buying when the MACD line crosses above the signal line, and selling when it crosses below.

Volume Signal: Compares current volume against the 20-period moving average to identify significant volume spikes. This helps in determining if the market is supported by strong volume.

Customization Options:

Moving Average Length: Customize the 20-period MA length to better fit your trading style or the asset you’re analyzing.

Supertrend Settings: Adjust the Supertrend factor and ATR period for different timeframes or volatility environments.

Table Position: Customize where the signal table is displayed on the chart (Top Right, Top Left, Bottom Right, or Bottom Left).

Table Appearance: Set the table background color and choose between small or tiny text size for better readability.

Signal Summary:

The indicator computes a combined signal based on the number of "Buy" or "Sell" signals from the individual indicators. If 5 or more indicators suggest a "Buy" or "Sell," the table will display a combined signal for easier decision-making. This feature consolidates the signals into one straightforward output, helping you filter noise and act on clear trends.

Table Display:

The customizable table organizes the signals of the key indicators, showing:

Indicator: Lists all the indicators in use, such as VWAP, Alligator, Supertrend, etc.

Signal: Displays "Buy," "Sell," or "Neutral" for each indicator based on the current market conditions.

Intended Use:

This script is designed to help traders monitor multiple technical indicators at once, giving them a clearer view of the market’s trend strength, momentum, and volatility. While it simplifies the process of interpreting various signals, users should use it in combination with their own research and risk management strategies.

Disclaimer: This script is for educational purposes only and should not be considered financial advice. All trading involves risk, and the performance of an indicator in the past does not guarantee future results. Always perform due diligence and use proper risk management techniques.

3 days ago

Release Notes

A "Buy" triangle is plotted below the bar if the signal changes to "Buy".

A "Sell" triangle is plotted above the bar if the signal changes to "Sell".

Script Name: Trend, Momentum, and Price Value Analysis

The Trend, Momentum, and Price Value Analysis script provides a multi-faceted approach to market analysis, combining several technical indicators into a single tool. This script offers an easy-to-interpret table summarizing various indicator signals, along with visual buy/sell signals on the chart.

Key Features:

VWAP (Volume Weighted Average Price):

The VWAP provides insights into whether the current price is above or below the average weighted price, helping traders identify potential buy or sell opportunities.

Alligator Indicator (Simplified):

Using three simple moving averages (SMAs), this tool helps identify the beginning of trends and potential buy/sell zones based on the Alligator jaw, teeth, and lips.

Supertrend:

A trend-following indicator that determines whether the market is in a bullish or bearish phase based on ATR and factor inputs. The Supertrend line is plotted on the chart.

20-period Moving Average (MA):

A basic moving average that assists in gauging price direction and the overall trend.

ADX (Average Directional Index):

Helps identify the strength of a trend. A value above 25 indicates a strong trend.

RSI (Relative Strength Index):

Measures momentum by identifying overbought and oversold conditions. A signal is triggered when RSI is above 60 (buy) or below 40 (sell).

MACD (Moving Average Convergence Divergence):

A momentum indicator that provides signals when the MACD line crosses the signal line.

Volume Signal:

Compares the current volume with a 20-period average to determine if volume supports the current trend direction.

Signal Table:

A table is generated on the chart, displaying real-time signals from each of the above indicators. The table is customizable with background colors and text sizes.

The position of the table can be set to any corner of the chart for convenience.

Combined Signal Logic:

The script calculates a Combined Signal based on the majority of buy or sell signals across all the indicators. If 5 or more indicators give a buy or sell signal, a combined signal is generated.

Buy/Sell Signal Plots:

The script plots buy (green triangle) and sell (red triangle) signals on the chart based on the combined signal when transitioning from a previous opposite signal.

Customizable Inputs:

Users can customize the length of the moving averages, adjust the background and text colors of the table, and choose the position of the table on the chart.

Fibonacci Levels on Any Indicator [By MUQWISHI]▋ INTRODUCTION :

A “Fibonacci Levels on Any Indicator” can be applied to any indicator to draw Fibonacci levels based on provided conditions of two price points to produce a sequence of horizontal line levels starting from 0% to 100% in addition to extension levels. The 0% level is measured as the start of retracement, while the 100% level is the beginning of the extension levels. This tool was developed to be easy to add to any indicator, and it could be valuable to some traders in terms of managing trades by setting targets and reducing risk in the trend direction.

_______________________

▋ USAGE:

➤ NEEDS TO IDENTIFY 4 ELEMENTS:

1. Starting Point. What’re the conditions / When will the drawing of the Fibonacci levels begin?

2. Ending Point. What’re the conditions / When will the drawing of the Fibonacci levels end?

3. High Point. What is the price for a 100% Fibonacci level (0% for the downside)?

4. Low Point. What is the price for a 0% Fibonacci level (100% for the downside)?

➤ STARTING & ENDING POINTS CONDITIONS:

Need to specify the condition when the drawing of Fibonacci levels starts and ends, and the indicator shows different prepared conditions.

New Phase: Import a value (plot) from an existing indicator, where its status changes from NaN to a real number.

Crosses Above/Below: Import a value(1) (plot) from an existing indicator, where it crosses above/below value(2).

Reversal Up/Down: Import a value(1) (plot) from an existing indicator, where it rises/decreases than the previous value(1).

First/Last Bar: Useful to draw stationary Fibonacci levels.

➤ UPPER & LOWER PIVOTS (0% & 100%):

Need to specify the two price points representing 0% & 100% Fibonacci levels to expose the sequence of Fibonacci lines.

Upper Pivot. By default, the ATR Upper Band. It’s possible to import a custom value from an existing indicator.

Lower Pivot. By default, the ATR Lower Band. It’s possible to import a custom value from an existing indicator.

➤ FIBONACCI STYLING OPTIONS:

Ability to customize line & label style, color, reverse, and hide/show levels.

_______________________

▋ IMPLEMENTATION:

Here are some examples of implementing the indicator.

Note: All presented examples below are for demonstration purposes, and they're not trading suggestions.

# Example 1: (Reversal Up/Down)

We want to implement Fibonacci levels on the Hull MA by mohamed982 . Our requirements are as follows:

Fibonacci levels start when the Hull MA reverses up.

Fibonacci levels end when the Hull MA reverses down.

Upper Pivot is the ATR Upper Band.

Lower Pivot is the ATR Lower Band.

After adding the required indicator (Hull MA), here’re the implementation and results

# Example 2: (Crosses Above/Below)

We want to implement Fibonacci Level on the Squeeze Momentum by LazyBear . Our requirements are as follows:

Fibonacci levels start when the Squeeze Momentum histogram crosses above 0.

Fibonacci levels end when the Squeeze Momentum histogram crosses below 0.

Upper Pivot is the Bollinger Upper Band.

Lower Pivot is the Bollinger Lower Band.

After adding the required indicators (Squeeze Momentum & Bollinger Band), here’re the implementation and results

# Example 3: (Crosses Above/Below)

We want to implement Fibonacci Level on the Crossing Moving Averages. Our requirements are as follows:

Fibonacci levels start when the 20-EMA crosses above 100-MA.

Fibonacci levels end when the 20-EMA crosses below 100-MA.

Upper Pivot is the ATR Upper Band.

Lower Pivot is the ATR Lower Band.

After adding the required indicators (20-EMA & 100-MA), here’re the implementation and results

# Example 4: (New Phase: When the previous value is NaN, and the current value is a real number.)

We want to implement Fibonacci Level on the Supertrend. Our requirements are as follows:

Fibonacci levels start when an up-Supertrend (green) line shows up.

Fibonacci levels end when a down-Supertrend (red) line shows up.

Upper Pivot is the down-Supertrend.

Lower Pivot is the up-Supertrend.

After adding the required indicator (Supertrend), here’re the implementation and results

# Example 5: (First/Last Bar)

We want to implement Fibonacci Level between two points, 330 & 300. Our requirements are as follows:

Fibonacci levels start at first bar on the chart.

Fibonacci levels end at last bar on the chart.

Upper Pivot is 330.

Lower Pivot is 300.

Here’re the implementation and results.

To customize the number of bars back (like 50 bars)

_______________________

▋ Final Comments:

The “Fibonacci Levels on Any Indicator” is made to apply on other indicators for planning Fibonacci Levels.

It can be implemented in different ways, along with presented examples.

This indicator does not work with plots that were developed by drawing classes.

Please let me know if you have any questions.

Thank you.

VANILLA BUY SELLThis script uses three components:-

USEFUL MA by @ALEXGROVER

SUPERTREND INDICATOR(3 supertrend with different ATR and multiplier) provided by tradingview.

VIX FEAR GAUGE by @bizkitbr

To make it easy and line free, supertrend lines have been removed but the color fill has been kept. This makes the chart clean.

For option traders, direction and momentum is everything. Hence, two need to be really clear:-

a) BUY OR SELL

b) Whether momentum exists of not

While rise is charecterised by a steady pace, a fall is charecterized by a rapid decline.

So in order to make the best use of of the charecters, a careful interpretation and backtesting has been done to enable buy sell only when vix conditions are met.

BUY SIGNAL

A buy signal is generated on following conditions:-

a)PRICE CLOSE ABOVE USEFUL MA

B)ALL THREE SUPERTRENDS ARE GREEN

C)VIXFIX IS BELOW 0.18.

SELL SIGNAL

This is generated when following is met:-

A) PRICE BELOW USEFUL MA

B)ALL THREE SUPERTRENDS ARE RED

C)VIXFIX IS ABOBE 0.18

ADDITIONALLY, A SMALL BACKGROUND COLOR CHANGE PROVIDED FOR AREAS WHERE THERE IS A BUY OR SELL.

Either labels can be used or background colours referred for seeing buy or sell.

Strategy Builder Crypto V6Hello everyone

This indicator is the result of 7 years of trading (including 3 years of analyzing day and night how crypto assets behave).

I made it fully customizable but I wouldn't recommend changing the default values as they're the most optimal ones for now. Might change in the future but I'm very happy with the signals so far and I hope you'll be as well :)

Without further due, let's dig into it...

0 - Algo trading and Why

In the crypto trading, there is a lot of useless noise (we can probably thank Crypto Twitter for that :p) and a lot of useless data with the sole purpose is to lure you (who said Bitfinex Long/Short ratio or CME gaps ??)

I wanted to remove all the useless and only focus on Technical Analysis (TA) because I was deeply convinced that TA includes by design Fundamental Analysis (FA) and Pumponomics Analysis (PA) - PA being for instance when your favorite twitter guru will pump and dump on you

I heard that so many people got REKT from the previous bear market and I wanted to give back to the community - who helped me so much a few years back.

I worked hard to design the method and make it simple for the public and for FREE (so far as I want to collect feedbacks from the community and improving the indicator)

THIS IS MY GIFT TO YOU

1 - Input values

I'll explain later on through a medium article what each parameter means and how to set them up. For now, please used the optimized and recommended values already set in the indicator

2 - The method

This method works for intraday trading for timeframes between m5 and H1. Any timeframe above could work but would give signals too late - in this case, I would recommend changing the inputs with smaller values to adjust

I see a trend being composed of a main trend, and mini sub trends. In other words, for instance, a weekly bullish trend is made of smaller H4 bullish trends. Hope it makes sense so far

Let's call the weekly trend the MAIN trend and the H4 smaller trends the SECONDARY trends

That's exactly what this indicator is about

It will catch the best MAIN trend and all the SECONDARY trends in the same direction of the MAIN trend.

It's up to you if you want to take all the SECONDARY trends or only the first one in the sequence.

3 - Invalidation signal

A signal invalidation is used to make you exiting your position with a small loss before your stop loss will get hit. Very powerful way to save your capital and limit your losses.

You'll find the indicator here on tradingview for free under the name Trend signal with Alert (made by myself)

Trend signal with Alert

to invalidate entries. You'll need to request an invite

Briefly, let's assume we get a BUY signal. I would exit the position either if I'm getting a DOWN trend signal. It means, if the oblique/logarithmic trendline is broken, then it's better to exit the position and wait for the indicator to give another BUY signal later hopefully

Best case, it will limit your loss in case the asset will dump.

Worst case, this strict management strategy will make you exiting your position for no reason and you'll re-enter later (with a signal) at almost the same price or a bit higher

In the long run, this method will prevent you from having big losses

4 - Stop Loss and Take profits levels

It's really up to you. It depends of your capital and psychology

This indicator is made to give big moves but that's not 100% guaranteed. You can draw some trendlines or use moving averages in big timeframes to set your take profit and stop loss levels.

I personally use this also, along with fibonacci on the weekly/monthly timeframes for my take profit levels

As I'm a nice person, I'm linking the Fibonacci indicator that I use here

Automatic Multi-timeframes fibonacci zones

. You'll also need to request an invite for that one

4-bis - Trailing stop

Not financial advice but I use a supertrend and I have a software that will trail my stop according to that supertrend level

For LONG positions, we could set the trailing below the supertrend.

For SHORT positions, we could set the trailing above the supertrend.

You'll find the indicator here on tradingview for free under the name Supertrend V1.0 - Buy or Sell Signal

5 - Which assets

It's working with the default values on major/mid/small caps and for ALTS/BTC, ALTS/USD and ALTS/ETH pairing

YES, THIS IS MOST AWESOME THING OF THE ENTIRE UNIVERSE !!!

6 - Best setup

m15 timeframe is my preferred one for this method. Best Risk/Reward/Invalidations ratio among all other timeframes

I strongly recommend to use the Trend Signal with the input value 14 for the invalidations

If you enter on a BUY signal, and get a RED trend signal, exit immediately the position without waiting for any other confirmation/pullback or anything else

If you enter on a SELL signal, and get a BLUE trend signal, exit immediately the position without waiting for any other confirmation/pullback or anything else

For the trailing stop/Supertrend value, it depends of your capital and how big your stop loss should be. I personally use the settings in the Supertrend indicator

7 - Alerts

You can setup alerts for the primary and secondary signals in Tradingview so that you won't have to stare at the charts all day long. You mental healthy is my priority above everything else :)

8 - More to come

I personally use the alerts from this indicator coupled with a system to take the trades given by the tradingview alerts. I'll publish it later on if I feel the indicator collects enough interest from you guys

7-Channel Trend Meter v3🔥 7-Channel Trend Meter – Ultimate Trend Confirmation Tool 💹

Purpose: Supplementary indicator used as confirmation

The 7-Channel Trend Meter offers an all-in-one confirmation system that combines 7 high-accuracy indicators into one easy-to-read visual tool. Say goodbye to guesswork and unnecessary tab-switching—just clear, actionable signals for smarter trades. Whether you're trading stocks, crypto, or forex, this indicator streamlines your decision-making process and enhances your strategy’s performance.

⚙️ What’s Inside The Box?

Here is each tool that the Trend Meter uses, and why/how they're used:

Average Directional Index: Confirms market strength ✅

Directional Movement Index: Confirms trend direction ✅

EMA Cross: Confirms reversals in trend through average price ✅

Relative Strength Index: Confirms trend through divergences ✅

Stochastic Oscillator: Confirms shifts in momentum ✅

Supertrend: Confirms trend-following using ATR calculations ✅

Volume Delta: Confirms buying/selling pressure weight by finding differences ✅

🧾 How To Read It:

🟨 Bar 1 – Market Strength Meter:

Light Gold 🟡: Strong market with trending conditions.

Dark Gold 🟤: Weakening market or consolidation—proceed with caution.

📊 Bars 2 to 7 – Trend Direction Confirmations:

🟩 Green: Bullish signal, uptrend likely.

🟥 Red: Bearish signal, downtrend likely.

💯 Why it's helpful to traders:

✅ 7 Confirmations in 1 View: No need to flip between multiple charts.

✅ Visual Clarity: Spot trends instantly with a quick glance.

✅ Perfect for Entry Confirmation: Confirm trade signals before pulling the trigger.

✅ Boosts Your Win Rate: Make data-backed decisions, not guesses.

✅ Works Across Multiple Markets: Stocks, crypto, forex—you name it 🌍.

🤔 "What's with the indicator mashup/How do these components work together? 🤔

The 7-Channel Trend Meter is designed as an original and useful tool that integrates multiple indicators to enhance trading decisions, rather than merely combining existing tools without logical coherence. This strategic mashup creates a comprehensive analysis framework that offers deeper insights into market conditions by capitalizing on each component's unique strengths. The careful integration of seven indicators creates a unified system that eliminates conflicting signals and enhances the decision-making process. Rather than simply merging indicators for the sake of it, the 7-Channel Trend Meter is designed to streamline trading strategies, making it a practical tool for traders across various markets. By leveraging the combined strengths of these indicators, traders can act with greater confidence, backed by comprehensive data rather than fragmented insights. Here’s how they synergistically work together:

Average Directional Index (ADX) and Directional Movement Index (DMI): The reason for this mashup is because ADX indicates the strength of the prevailing trend, while the DMI pinpoints its direction. Together, they equip traders with a dual framework that not only identifies whether to engage with a trend but also quantifies its strength, allowing for more decisive trading strategies.

EMA Cross: The reason for this addition to the mashup is because this tool signals potential trend reversals by identifying moving average crossovers. When combined with the ADX and DMI, traders can better differentiate between genuine trend shifts and market noise, leading to more accurate entries.

Relative Strength Index (RSI) and Stochastic Oscillator: The reason for this mashup is because by using both momentum indicators, traders gain a multifaceted view of market dynamics. The RSI assesses overbought or oversold conditions, while the Stochastic Oscillator confirms momentum shifts. When both agree with the trend signals from the DMI, it enhances the reliability of reversal or continuation strategies.

Supertrend: The reason for this addition to the mashup is because as a trailing stop based on market volatility, the Supertrend indicator works hand-in-hand with the ADX’s strength assessment, allowing traders to ride strong trends while managing risk. This cohesion prevents premature exits during minor pullbacks.

Volume Delta: The reason for this addition to the mashup is because integrating volume analysis helps validate signals from the price action indicators. Significant volume behind a price movement reinforces the likelihood of its continuation, ensuring that traders can act on well-supported signals.

🔍 How it does what it says it does 🔍

While the exact calculations remain proprietary, the following outlines how the components synergistically work to aid traders in making informed decisions:

Market Strength Assessment: Average Directional Index (ADX)

This component is used as confirmation by measuring the strength of the market trend on a scale from 0 to 100. A reading above 20 generally indicates a strong trend, while readings below 20 suggest sideways movement. The Trend Meter flags strong trends, effectively helping traders identify optimal conditions for entering positions.

Trend Direction Confirmation: Directional Movement Index (DMI)

This component is used as confirmation by distinguishing between bullish and bearish trends by evaluating price movements. This combination allows traders to confirm not only if a trend exists but also its direction, informing whether to buy or sell.

Trend Reversal Detection: Exponential Moving Average (EMA) Cross

This component is used as confirmation by calculating two EMAs (one shorter and one longer) to identify potential reversal points. When the shorter EMA crosses above the longer EMA, it signals a bullish reversal, and vice versa for bearish reversals. This helps traders pinpoint optimal entry or exit points.

Momentum Analysis: Relative Strength Index (RSI) and Stochastic Oscillator

These components are used as confirmation by providing insights into momentum. The RSI assesses the speed and change of price movements, indicating overbought or oversold conditions. The Stochastic Oscillator compares a particular closing price to a range of prices over a specified period. This helps identify whether momentum is slowing or speeding up, offering a clear view of potential reversal points. When both the RSI and Stochastic Oscillator converge on signals, it increases the reliability of those signals in trading decisions.

Volatility-Based Trend Following: Supertrend

This component is used as confirmation by utilizing Average True Range (ATR) calculations to help traders stay in momentum-driven trades by providing dynamic support and resistance levels that adapt to volatility. This enables better risk management while allowing traders to capture stronger trends.

Volume Confirmation: Volume Delta

This component is used as confirmation by analyzing buying and selling pressure by measuring the difference between buy and sell volumes, offering critical insights into market sentiment. Significant volume behind a price movement increases confidence in the sustainability of that move.

🧠 Pro Tip:

When all 7 bars line up in green or red, it’s time to take action: load up for a confirmed move or sit back and wait for market confirmation. Let the Trend Meter guide your strategy with precision.

Conclusion:

Integrate the 7-Channel Trend Meter as useful confirmation for your TradingView strategy and stop trading like the average retail trader. This tool eliminates the noise and helps you stay focused on high-confidence trades.

Options Scalping V2This Indicator is Owned by Team Option Scalping.

It has 4 Plots and 2 Tables.

This indicator to be used only in BankNifty Futures

VWAP ( Volume weighted average price )

• User can input the source and enable/disable the VWAP from input section.

• When price is more than the VWAP its Bullish Trend and vice versa.

VWMA ( Volume weighted moving average )

• Default value of 20 is used in VWMA . User can enable/disable it from input section.

• When price is more than the VWMA its Bullish Trend and vice versa.

Parabolic SAR

• User can input “start”, “increment” and “maximum” values from input section and can enable/disable SAR also.

• When price is more than the Parabolic SAR its Bullish Trend and vice versa.

SuperTrend

• User can input ATR Period and ATR Multiplier values from input section. By defaults it’s 10 and 2.

• User have option of enable/disable “Change ATR calculation Method”, if enabled then ATR is calculated differently for SuperTrend.

• Enable/disable “BUY/SELL signals” on SuperTrend.

• When price is more than the SuperTrend its Bullish Trend and vice versa.

Top Right Corner TABLE ( 6 , 10 )

When you are trading in Banknifty futures , we have to check major Banks which is contributing to Banknifty move. So we have given that in this tab.

This table consist data of 9 following stocks:

• BankNifty

• Nifty

• Dow

• INDIA

• VIX

• HDFC

• ICICI

• KOTAK

• AXIS

• SBI

And following data of each stock has been provided:

• LTP

• Daily Change

• Daily Percentage Change

• 15-minute Change Percentage

• 1-Hour Change Percentage

Bottom Right Corner TABLE (3, 6 )

This table consist of 4 indicators values and Up/Down indicator:

• VWMA (When price is more than the VWMA its Bullish and vice versa)

• SuperTrend (10.2, When price is more than the SuperTrend its Bullish and vice versa.)

• RSI (14)

• VWAP (When price is more than the VWAP its Bullish and vice versa.)

BTC 4h bot 2.0 AlertsThis is Alert version of BTC 4h bot 2.0.

Optimized for pairs BTC vs stablecoins, 4h timeframe.

HOW IT WORKS:

Script is based on the fact that there are certain phases of the market when there is a greater probability that BTC will go to one side or the other. To evaluate which phase we are in, the script uses "Main trend" and "Confirmation signals".

Main trend

- Is composed of a combination of several supertrends and moving averages. A Supertrend is a trend following indicator that helps in identifying whether we are in an uptrend or a downtrend. A higher factor is used to capture the main trend and not just small movements. In case the market goes sideways, the Supertrend does not work well, so it is a combination of multiple supertrends along with moving averages to differentiate a real strong trend from a range.

- It can be seen on the graph as a thick solid line.

- In an uptrend is green, in a downtrend red, gray represents the neutral zone.

Confirmation signals

- Are several script-evaluated indicators such as RSI , MACD , ADX and others, which serve to confirm the trend. In this case, it is the opposite way to the Main trend. Confirmation signals are used here to detect small movements. They are trying to capture bullish and bearish price momentum.

- On the graph they are seen as dashed lines above or below the Main trend (in the gray zone they are in the middle).

- It indicates only two signals, green for buy and red for sell.

HOW TO USE IT:

if the Main trend and Confirmation signals are of the same color, it will send a buy or sell signal, depending on which phase of the trend it is in. If the Main trend is e.g. in an uptrend and the market is going up, Confirmation signals should generate a lot of signals. But if the market starts to go in the opposite direction, Confirmation signals should generate fewer signals or none at all, thus reducing the number of wrong trades. In the gray zone of the Main trend it does not open positions.

To close position is possible to use stop loss and take profit or alternative could be to set very high TP value, thereby letting the script close the positions by itself by Stop Long or Stop Short.

The recommended setting is:

TP: 3.9%

SL: 4.7%.

In this case, it is a Alert version, where can be seen all the signals, which the script generates.

Green triangels indicate open Long.

Red triangels indicate open Short.

Small blue triangels indicate Stop Long position.

Small orange triangels indicate Stop Short position.

Signal is valid after bar is closed, so do not open a position before.

Script works well on Bitstamp, but also other exchanges with pair BTC/USD or BTC/stablecoins.

The script works consistently well over a long period of time, using past probabilities, but this does not guarantee future results.

Gedhusek MasterReversionThe MasterReversion Indicator works as a scanner for possible price reversals.

How does it work?:

The main feature of this indicator is finding extreme price deviations from its mean. This is reached by calculating the average price deviation from its mean and then comparing it with the current price deviation. This deviation is expressed as a percentage in relation to the historically highest price deviation --> if the maximum deviation is 200 points and the current deviation is 180 points, than the percentage displayed is going to be 90%.

With knowing how extreme the current deviation is, we can do some good decision making about whether the market is ready to reverse to its mean or not.

The next feature of this indicator is classic SuperTrend indicator. This tool is mainly used for identifying shifts in the market trend and in this case it becomes very useful when catching the actual price reversion.

The key idea:

The main idea behind this tool is that the price can be away from moving average, but cant stay that way forever. Therefore its convenient to know when the reversion part might happen

How to use:

Generally, you would want to wait until the current price reaches certain percentage (you can see a label on the latest bar displaying current percentage deviation). After that happens, wait for a sign of pullback. For that you can use the built-in SuperTrend indicator or any other strategy that you like. Your potential Take Profit should be somewhere around the main moving average (it has a white colour) as you are speculating on mean reversion.

[

Settings:

MA Period = Period of a moving average. Price deviations will be relative to this moving average, so as the value is larger, you will catch more significant price deviations and vice versa

Percentage Trigger = Specifies what percentage do you consider as significant.

ATR Period = Settings for a SuperTrend. Specifies a period of an ATR indicator. I like to use values 22 or 34. As the value is higher, the indicator will be generally less sensitive

ATR Multiplier = Also specifies a sensitivity of SuperTrend. As the value is higher, the SuperTrend is going to be less sensitive and vice versa

I would personally encourage you to experiment with the indicator first, so you can decide which inputs are the best ones for your style of trading.

Which markets and Time Frame:

This indicator works best on Forex and can be used on any TF.

It is possible to use it also on other instruments, but the settings has to be adjusted more.

Uptrick: MultiTrend Squeeze System**Uptrick: MultiTrend Squeeze System Indicator: The Ultimate Trading Tool for Precision and Versatility 📈🔥**

### Introduction

The MultiTrend Squeeze System is a powerful, multi-faceted trading indicator designed to provide traders with precise buy and sell signals by combining the strengths of multiple technical analysis tools. This script isn't just an indicator; it's a comprehensive trading system that merges the power of SuperTrend, RSI, Volume Filtering, and Squeeze Momentum to give you an unparalleled edge in the market. Whether you're a day trader looking for short-term opportunities or a swing trader aiming to catch longer-term trends, this indicator is tailored to meet your needs.

### Key Features and Unique Aspects

1. **SuperTrend with Dynamic Adjustments 📊**

- **Adaptive SuperTrend Calculation:** The SuperTrend is a popular trend-following indicator that adjusts dynamically based on market conditions. It uses the Average True Range (ATR) to calculate upper and lower bands, which shift according to market volatility. This script takes it further by combining it with the RSI and Volume filtering to provide more accurate signals.

- **Direction Sensitivity:** The SuperTrend here is not static. It adjusts based on the direction of the previous SuperTrend value, ensuring that the indicator remains relevant even in choppy markets.

2. **RSI Integration for Overbought/Oversold Conditions 💹**

- **RSI Calculation:** The Relative Strength Index (RSI) is incorporated to identify overbought and oversold conditions, adding an extra layer of precision. This helps in filtering out false signals and ensuring that trades are taken only in optimal conditions.

- **Customizable RSI Settings:** The RSI settings are fully customizable, allowing traders to adjust the RSI length and the overbought/oversold levels according to their trading style and market.

3. **Volume Filtering for Enhanced Signal Confirmation 📉**

- **Volume Multiplier:** This unique feature integrates volume analysis, ensuring that signals are only generated when there is sufficient market participation. The Volume Multiplier can be adjusted to filter out weak signals that occur during low-volume periods.

- **Optional Volume Filtering:** Traders have the flexibility to turn the volume filter on or off, depending on their preference or market conditions. This makes the indicator versatile, allowing it to be used across different asset classes and market conditions.

4. **Squeeze Momentum Indicator (SMI) for Market Pressure Analysis 💥**

- **Squeeze Detection:** The Squeeze Momentum Indicator detects periods of market compression and expansion. This script goes beyond the traditional Bollinger Bands and Keltner Channels by incorporating true range calculations, offering a more nuanced view of market momentum.

- **Customizable Squeeze Settings:** The lengths and multipliers for both Bollinger Bands and Keltner Channels are customizable, giving traders the flexibility to fine-tune the indicator based on their specific needs.

5. **Visual and Aesthetic Customization 🎨**

- **Color-Coding for Clarity:** The indicator is color-coded to make it easy to interpret signals. Bullish trends are marked with a vibrant green color, while bearish trends are highlighted in red. Neutral or unconfirmed signals are displayed in softer tones to reduce noise.

- **Histogram Visualization:** The primary trend direction and strength are displayed as a histogram, making it easy to visualize the market's momentum at a glance. The height and color of the bars provide immediate feedback on the strength and direction of the trend.

6. **Alerts for Real-Time Trading 🚨**

- **Custom Alerts:** The script is equipped with custom alerts that notify traders when a buy or sell signal is generated. These alerts can be configured to send notifications through various channels, including email, SMS, or directly to the trading platform.

- **Immediate Reaction:** The alerts are triggered based on the confluence of SuperTrend, RSI, and Volume signals, ensuring that traders are notified only when the most robust trading opportunities arise.

7. **Comprehensive Input Customization ⚙️**

- **SuperTrend Settings:** Adjust the ATR length and factor to control the sensitivity of the SuperTrend. This allows you to adapt the indicator to different market conditions, whether you're trading a volatile cryptocurrency or a more stable stock.

- **RSI Settings:** Customize the RSI length and thresholds for overbought and oversold conditions, enabling you to tailor the indicator to your specific trading strategy.

- **Volume Settings:** The Volume Multiplier and the option to toggle the volume filter provide an additional layer of customization, allowing you to fine-tune the indicator based on market liquidity and participation.

- **Squeeze Momentum Settings:** The lengths and multipliers for Bollinger Bands and Keltner Channels can be adjusted to detect different levels of market compression, providing flexibility for both short-term and long-term traders.

### How It Works: A Deep Dive Into the Mechanics 🛠️

1. **SuperTrend Calculation:**

- The SuperTrend is calculated using the ATR, which measures market volatility. The indicator creates upper and lower bands around the price, adjusting these bands based on the current level of market volatility. The direction of the trend is determined by the position of the price relative to these bands.

- The script enhances the standard SuperTrend by ensuring that the bands do not flip-flop too quickly, reducing the chances of false signals in a choppy market. The direction is confirmed by checking the position of the close relative to the previous band, making the trend detection more reliable.

2. **RSI Integration:**

- The RSI is calculated over a customizable length and compared to user-defined overbought and oversold levels. When the RSI crosses below the oversold level, and the SuperTrend indicates a bullish trend, a buy signal is generated. Conversely, when the RSI crosses above the overbought level, and the SuperTrend indicates a bearish trend, a sell signal is triggered.

- The combination of RSI with SuperTrend ensures that trades are only taken when there is a strong confluence of signals, reducing the chances of entering trades during weak or indecisive market phases.

3. **Volume Filtering:**

- The script calculates the average volume over a 20-period simple moving average. The volume filter ensures that buy and sell signals are only valid when the current volume exceeds a multiple of this average, which can be adjusted by the user. This feature helps filter out weak signals that might occur during low-volume periods, such as just before a major news event or during after-hours trading.

- The volume filter is particularly useful in markets where volume spikes are common, as it ensures that signals are only generated when there is significant market interest in the direction of the trend.

4. **Squeeze Momentum:**

- The Squeeze Momentum Indicator (SMI) adds a layer of market pressure analysis. The script calculates Bollinger Bands and Keltner Channels, detecting when the market is in a "squeeze" — a period of low volatility that typically precedes a significant price move.

- When the Bollinger Bands are inside the Keltner Channels, the market is in a squeeze (compression phase). This is often a precursor to a breakout or breakdown. The script colors the histogram bars black during this phase, indicating a potential for a strong move. Once the squeeze is released, the bars are colored according to the direction of the SuperTrend, signaling a potential entry point.

5. **Integration and Signal Generation:**

- The script brings together the SuperTrend, RSI, Volume, and Squeeze Momentum to generate highly accurate buy and sell signals. A buy signal is triggered when the SuperTrend is bullish, the RSI indicates oversold conditions, and the volume filter confirms strong market participation. Similarly, a sell signal is generated when the SuperTrend is bearish, the RSI indicates overbought conditions, and the volume filter is met.

- The combination of these elements ensures that the signals are robust, reducing the likelihood of entering trades during weak or indecisive market conditions.

### Practical Applications: How to Use the MultiTrend Squeeze System 📅

1. **Day Trading:**

- For day traders, this indicator provides quick and reliable signals that can be used to enter and exit trades multiple times within a day. The volume filter ensures that you are trading during the most liquid times of the day, increasing the chances of successful trades. The Squeeze Momentum aspect helps you catch breakouts or breakdowns, which are common in intraday trading.

2. **Swing Trading:**

- Swing traders can use the MultiTrend Squeeze System to identify longer-term trends. By adjusting the ATR length and factor, you can make the SuperTrend more sensitive to catch longer-term moves. The RSI and Squeeze Momentum aspects help you time your entries and exits, ensuring that you get in early on a trend and exit before it reverses.

3. **Scalping:**

- For scalpers, the quick signals provided by this system, especially in combination with the volume filter, make it easier to take small profits repeatedly. The histogram bars give you a clear visual cue of the market's momentum, making it easier to scalp effectively.

4. **Position Trading:**

- Even position traders can benefit from this indicator by using it to confirm long-term trends. By adjusting the settings to less sensitive parameters, you can ensure that you are only entering trades when a strong trend is confirmed. The Squeeze Momentum indicator will help you stay in the trade during periods of consolidation, waiting for the next big move.

### Conclusion: Why the MultiTrend Squeeze System is a Game-Changer 🚀

The MultiTrend Squeeze System is not just another trading indicator; it’s a comprehensive trading strategy encapsulated within a single script. By combining the power

of SuperTrend, RSI, Volume Filtering, and Squeeze Momentum, this indicator provides a robust and versatile tool that can be adapted to various trading styles and market conditions.

**Why is it Unique?**

- **Multi-Dimensional Analysis:** Unlike many other indicators that rely on a single data point or calculation, this script incorporates multiple layers of analysis, ensuring that signals are based on a confluence of factors, which increases their reliability.

- **Customizability:** The vast range of input settings allows traders to tailor the indicator to their specific needs, whether they are trading forex, stocks, cryptocurrencies, or commodities.

- **Visual Clarity:** The color-coded bars, labels, and signals make it easy to interpret the market conditions at a glance, reducing the time needed to make trading decisions.

Whether you are a novice trader or an experienced market participant, the MultiTrend Squeeze System offers a powerful toolset to enhance your trading strategy, reduce risk, and maximize your potential returns. With its combination of trend analysis, momentum detection, and volume filtering, this indicator is designed to help you trade with confidence and precision in any market condition.

Strong Candle and Probability Levels Light [SYNC & TRADE]Indicator Description: "Strong Candle and Probability Levels Light "

Core Philosophy: This indicator is not just a collection of random signals. It is a complete trading system built around two core concepts: Strength (Volume-based Candles) and Probability (Fibonacci Levels), synchronized between spot and futures markets to filter out noise and manipulations.

🎯 The "Strong Candle Defense" Strategy

The primary tactic is to enter in the direction of the market's dominant force at an optimal price.

1. Identifying Strength: The indicator identifies "Strong Candles" in real-time — candles with anomalously high volume and significant delta (buyer/seller dominance), confirmed across multiple timeframes. They are marked with circles (blue for bullish, red for bearish) and Z-level labels showing the statistical significance of the move.

2. "Ladder" Entry: We do not chase the market. The strategy is to wait for a pullback (retest) to the body of the strong candle or its key internal Fibonacci levels (38.2%, 50%, 61.8%) for a favorable entry. The position is built in parts ("scaling in") as the bounce is confirmed.