Обучение

Bull and Bear Traps!!!👨🏫

Hello, dear traders🙋🏻; I am Pejman, and welcome to TradingView Tunes📺. As a lover of classic cartoons, I would like to explain Bull and Bear Trap using the Road Runner and Coyote cartoons😍.

If you've never seen this cartoon👀, let me tell you, it's a masterpiece of trapping and pranking. But what does it have to do with financial markets🤷🏻❓

Believe it or not, there are some striking similarities between the traps Coyote🐺 sets for Road Runner🐦 and the traps that exist in financial markets💲. The market traps are known as bull🐮 and bear🐻 traps, and they can lead to significant losses if investors aren't careful.🙍🏻

For example, the Coyote paints🖌️ the road to drag the Road Runner to a suitable place and traps him with stones🪨 and TNT💣. Or he is trying to surprise the bird with TNT & cactus🌵, in another way.🤭

Large financial institutions and market makers, or whales🐋, try to deceive amateur traders in the financial markets. Like coyotes, they try to trap inexperienced people by creating fake buy🟢 and sell🔴 signals.

To trade with these traps, you should know technical analysis to neutralize the coyote traps of the market like Road Runner.😉

In the financial markets, we have two types of fraudsters. Bulls are the ones who buy and cause prices to rise☝🏻, and on the contrary, bears are the ones who sell and make prices fall👇🏻. Simple enough, right😊❓

However, I explained more about bulls and bears in the market types post👀. You can refer to this post to better understand the rest of the article.👇🏻😉

Every hunter needs prey. For example, we said that the Coyote used to paint the roads. Exactly bulls, by pumping up the price and bears by a sharp drop in the price, fool the inexperienced people. Also, all these events are short-term.

Like Road Runner, you have to pay close attention to the market⚠️.

In this post, I will teach you how to turn threats into opportunities and profit from them.✅

The first step is to identify these traps. Our first trip today is the bull trap.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Bull Trap:

Let's start with the Bull Trap🏁.

This is when the market looks like it's on the up-and-up⬆️, so you start throwing money around like a looney tune💸. But just like Coyote's contraptions, the market can suddenly backfire and leave you feeling like you just got hit with an anvil💥.

It's enough to make you want to go "meep meep" all the way home☹️🏠. Be like Road Runner and stay alert, or you'll end up with a crate of dynamite💣 strapped to your back. That's a bull trap in a nutshell.

A bull trap is when the market appears to increase, so investors jump in, hoping to make a profit. But then, the market suddenly drops, and those investors are left holding the bag👜. They thought they were getting ahead of the game but were just falling into a trap.🪤

You may be fooled by the chart and expect the price to pump up, but in reality, the price will start to fall or act like a reversal pattern.↩️

At this time, those who traded without stop loss🚫 will lose the most. It would help if you watched out for these traps in any type, whether up, down, or sideways (range market).

The price must be below a resistance zone for a bull trap to form a reversal pattern. A bull trap can change an uptrend to a downtrend after creating classic reversal patterns such as double tops, heads & shoulders, diamonds, etc.😉

If you want to know the patterns and learn classic patterns with a quick review⏩, you can get help from the following post.

Now that you know this trap, we can talk about ways to recognize and deal with this trap.

How to recognize the Bull Trap🔎

Sir John Templeton says: The four most dangerous words in investing are: "This time it's different."🤔

We may have said these words and confused real traps with fake traps. But how can you prevent this mistake?🤷🏻

Do you remember that we talked about fake and valid breakouts in the Support and Resistance post?💭

You can also read the link below for a background on this topic.

Let's go back to our topic. To ensure that the breakout is valid, we should look for two confirmation signs✅️:

1. Increase in Trading Volume

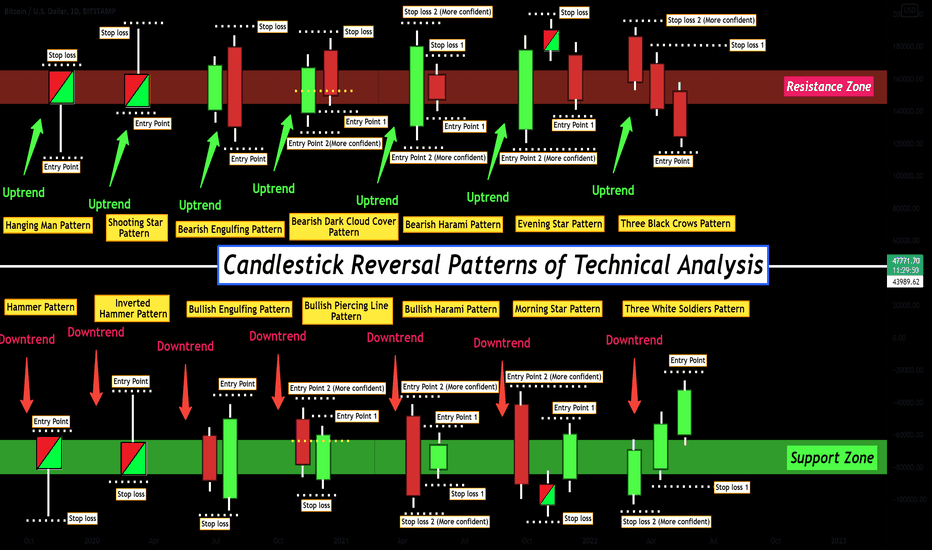

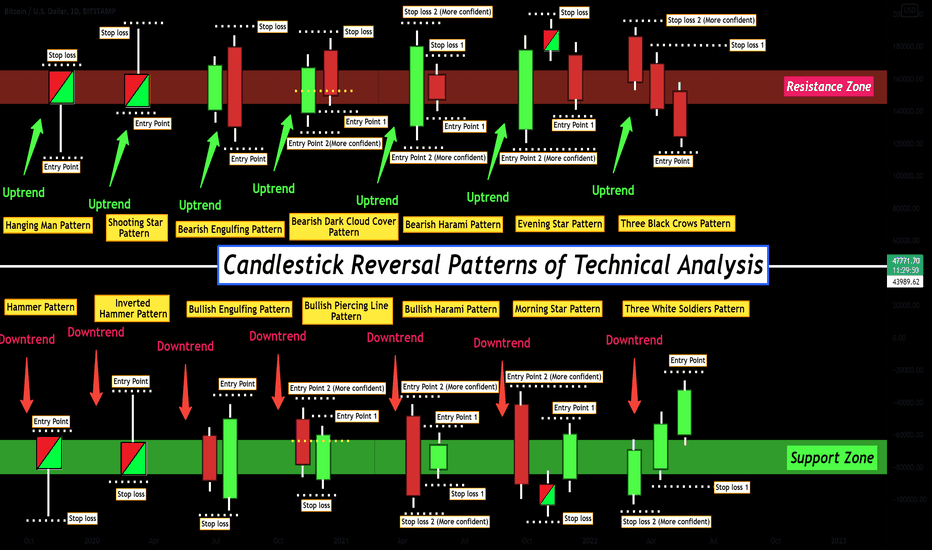

2. Bullish candlestick patterns

Now let's go through each one in detail because the devil👹 is in the details 😂.

For the breakout to be valid, the volume📶 of the broken candle must be significantly higher than the previous candles. But more is needed because coyotes are clever and intelligent. Even after the breakout, the trading volume for the other candles should remain high to ensure the failure is real.

In a bull trap, the volume of the fake breakout candles either does not increase or only slightly.

If you see that the trend has lost momentum after breaking out or has no strong momentum to continue or start the trend, this is precisely the trail of coyotes in the market.

Along with market volume, considering candlesticks and their patterns can be equally helpful as they clearly show market movement.

You can take a look at the following post to learn about these candlestick patterns and review them.

For example, by seeing bullish candlestick patterns, you can understand that a breakout is not fake.

If the breakout candle is a giant momentum candle, it's called a Marubozu, which is not difficult to find on the chart. This candle has a green and long body, and its wick is tiny compared to its body, or it does not have a wick at all.

This candle is associated with a high trading volume, and it shows that TNT is not working in this upward trend, and real buyers are in the market.

Also, the pattern of the 👩🚀👩🚀👨🚀Three White Soldiers👩🚀👨🚀👩🚀 is a reversal pattern that can be seen as a continuation pattern in the charts.

Along with all these signs, you should always keep the market trend in mind.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Bear Trap:

Next up is the Bear Trap.

This is when the market looks like it's going to crash💥 and burn🔥, so you start selling your assets like there's no tomorrow.

But just like Coyote's rockets, the market can suddenly bounce back and leave you feeling like you just got flattened by an Acme anvil.

Don't panic! Be like Road Runner and stay calm, or you'll fall off a cliff.

Bear traps are similar to bull traps. Young and inexperienced bears🐻 are caught in these traps.

When the young bears think the market is going down, these traps are activated, and the hunters place heavy buy orders.

At this moment, this heavy order will cause the price to turn upward, and anyone who has a short position without a stop loss will lose their money💸.

A trap is a trap, and it doesn't matter if it is a bear or a bull🐮. Here we use the duplicate confirmations we used in bull traps, like a steady increase in trading volume and continuation candlestick patterns.

When a support zone is broken, hunters prepare to set traps. If the bearish momentum candle is not accompanied by increased trading volume, this can be a sign of a trap.

The ⚫️⚫️⚫️Three Black Crow⚫️⚫️⚫️ candlestick pattern is usually a reversal pattern but sometimes acts as a continuation pattern. If a high trading volume accompanies this pattern, it can be a valid sign of a breakout.

Now I will tell you how to use these traps (Bull&Bear) and get profit from them like a professional trader.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

How to trade with a Bull Trap

The bull traps start with an uptrend. As you can see the picture has a resistance zone, and the price may test a zone several times before passing it.

When a fake breakout occurs, it may initially be accompanied by an increase in trading volume, but it is entirely temporary, and you will notice a decrease⤵️ in the intensity of the trend from the next candles.

When the intensity of the trend decreases, market coyotes activate their traps. And they set sell orders, and the bloody🩸 candles appear on the chart.

With a valid breakout of the last support, the price reaches our entry point station⛽️. You can place your stop loss a little higher than the top of the bull trap and place your stop loss🚫 above the breakout candlestick of the support zone, considering the higher Risk-Reward ratio.

To find the take profit💰 point, consider the difference between the peak trap and the support zone as X, and Viola, now expects X amount to profit from your entry point.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

How to trade with a Bear Trap

Now it's time for the second trap.

After occurring a valid support zone breakout and an increase in price, you must wait for the price to break through the last resistance zone after a sudden sharp move.

When you can use the signs⚠️, you are sure that the coyotes have abandoned the process, that there is no trap🪤, and that real failure has happened; you can open your long positions.

Now, this passed resistance zone has turned into support, and you can wait for the price to test this area several times for more confidence and then open your entry point.

Like trading in bull traps, in bear traps, you can place your stop loss a little below the valley of the bear trap.

Considering the higher Risk-Reward ratio, you can also put it below the breakout candle of the resistance zone.

The take-profit point is the same as the bull trap, but vice versa. Consider X from the lowest price in the bear trap and the resistance zone.

Now, as much as X, we can expect that the upward trend will continue and precious dollars will rain on our heads.

Now that you have learned about the bull trap🪤 in an uptrend and the bear trap in a downtrend↘️, you should remember that the market is not always up🔺️ and down🔻, and the road runner should also expect traps on the range roads. You should be aware of bull/bear traps in the range market.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Range Market

When the price gets stuck between the support and resistance zones, the range market is created, and the coyotes also look for inexperienced road runners in this market.

This is a sad story for new traders who rush into positions when they see the resistance or support zone break.

Price fluctuations in range markets are minor; trading in a range market is much more complex than in bull and bear markets.

So I suggest you spend more time on your trading strategies and test them several times.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Conclusion:

Even in life, some coyotes seek to trick you by creating fake situations. But you have to be careful and smart like Road Runner.

Sir John Templeton believes that: "Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria."

And also, David Dreman says: "Bear markets are like avalanches: they start slowly and accelerate gradually before gaining momentum and becoming a force of nature🏞."

In the financial markets, bulls and bears are constantly fighting each other, but the real winners are always those who use various tools and indicators to avoid risk and find safe spots for trading and profit.

Once you practice and familiarize your eyes with all kinds of trends and traps, you will become a road runner in the market.

So, if you want to be like the clever road runner and avoid falling into the bull and bear traps in the financial markets, stay alert, stay informed, and be prepared to adapt your investment💰 strategy when necessary.

In future posts, we will take new steps in technical analysis and travel to the world of classic patterns. So follow the future posts and share your opinions and ideas in the comments. Your comments🎓 are precious to me.

Also, if you have friends👬👭 who are into classic cartoons🎆 and trading, send them this post.

If you've never seen this cartoon👀, let me tell you, it's a masterpiece of trapping and pranking. But what does it have to do with financial markets🤷🏻❓

Believe it or not, there are some striking similarities between the traps Coyote🐺 sets for Road Runner🐦 and the traps that exist in financial markets💲. The market traps are known as bull🐮 and bear🐻 traps, and they can lead to significant losses if investors aren't careful.🙍🏻

For example, the Coyote paints🖌️ the road to drag the Road Runner to a suitable place and traps him with stones🪨 and TNT💣. Or he is trying to surprise the bird with TNT & cactus🌵, in another way.🤭

Large financial institutions and market makers, or whales🐋, try to deceive amateur traders in the financial markets. Like coyotes, they try to trap inexperienced people by creating fake buy🟢 and sell🔴 signals.

To trade with these traps, you should know technical analysis to neutralize the coyote traps of the market like Road Runner.😉

In the financial markets, we have two types of fraudsters. Bulls are the ones who buy and cause prices to rise☝🏻, and on the contrary, bears are the ones who sell and make prices fall👇🏻. Simple enough, right😊❓

However, I explained more about bulls and bears in the market types post👀. You can refer to this post to better understand the rest of the article.👇🏻😉

Every hunter needs prey. For example, we said that the Coyote used to paint the roads. Exactly bulls, by pumping up the price and bears by a sharp drop in the price, fool the inexperienced people. Also, all these events are short-term.

Like Road Runner, you have to pay close attention to the market⚠️.

In this post, I will teach you how to turn threats into opportunities and profit from them.✅

The first step is to identify these traps. Our first trip today is the bull trap.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Bull Trap:

Let's start with the Bull Trap🏁.

This is when the market looks like it's on the up-and-up⬆️, so you start throwing money around like a looney tune💸. But just like Coyote's contraptions, the market can suddenly backfire and leave you feeling like you just got hit with an anvil💥.

It's enough to make you want to go "meep meep" all the way home☹️🏠. Be like Road Runner and stay alert, or you'll end up with a crate of dynamite💣 strapped to your back. That's a bull trap in a nutshell.

A bull trap is when the market appears to increase, so investors jump in, hoping to make a profit. But then, the market suddenly drops, and those investors are left holding the bag👜. They thought they were getting ahead of the game but were just falling into a trap.🪤

You may be fooled by the chart and expect the price to pump up, but in reality, the price will start to fall or act like a reversal pattern.↩️

At this time, those who traded without stop loss🚫 will lose the most. It would help if you watched out for these traps in any type, whether up, down, or sideways (range market).

The price must be below a resistance zone for a bull trap to form a reversal pattern. A bull trap can change an uptrend to a downtrend after creating classic reversal patterns such as double tops, heads & shoulders, diamonds, etc.😉

If you want to know the patterns and learn classic patterns with a quick review⏩, you can get help from the following post.

Now that you know this trap, we can talk about ways to recognize and deal with this trap.

How to recognize the Bull Trap🔎

Sir John Templeton says: The four most dangerous words in investing are: "This time it's different."🤔

We may have said these words and confused real traps with fake traps. But how can you prevent this mistake?🤷🏻

Do you remember that we talked about fake and valid breakouts in the Support and Resistance post?💭

You can also read the link below for a background on this topic.

Let's go back to our topic. To ensure that the breakout is valid, we should look for two confirmation signs✅️:

1. Increase in Trading Volume

2. Bullish candlestick patterns

Now let's go through each one in detail because the devil👹 is in the details 😂.

- Increase in Trading Volume

For the breakout to be valid, the volume📶 of the broken candle must be significantly higher than the previous candles. But more is needed because coyotes are clever and intelligent. Even after the breakout, the trading volume for the other candles should remain high to ensure the failure is real.

In a bull trap, the volume of the fake breakout candles either does not increase or only slightly.

If you see that the trend has lost momentum after breaking out or has no strong momentum to continue or start the trend, this is precisely the trail of coyotes in the market.

Along with market volume, considering candlesticks and their patterns can be equally helpful as they clearly show market movement.

You can take a look at the following post to learn about these candlestick patterns and review them.

For example, by seeing bullish candlestick patterns, you can understand that a breakout is not fake.

- Bullish Candlestick Patterns:

If the breakout candle is a giant momentum candle, it's called a Marubozu, which is not difficult to find on the chart. This candle has a green and long body, and its wick is tiny compared to its body, or it does not have a wick at all.

This candle is associated with a high trading volume, and it shows that TNT is not working in this upward trend, and real buyers are in the market.

Also, the pattern of the 👩🚀👩🚀👨🚀Three White Soldiers👩🚀👨🚀👩🚀 is a reversal pattern that can be seen as a continuation pattern in the charts.

Along with all these signs, you should always keep the market trend in mind.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Bear Trap:

Next up is the Bear Trap.

This is when the market looks like it's going to crash💥 and burn🔥, so you start selling your assets like there's no tomorrow.

But just like Coyote's rockets, the market can suddenly bounce back and leave you feeling like you just got flattened by an Acme anvil.

Don't panic! Be like Road Runner and stay calm, or you'll fall off a cliff.

Bear traps are similar to bull traps. Young and inexperienced bears🐻 are caught in these traps.

When the young bears think the market is going down, these traps are activated, and the hunters place heavy buy orders.

At this moment, this heavy order will cause the price to turn upward, and anyone who has a short position without a stop loss will lose their money💸.

A trap is a trap, and it doesn't matter if it is a bear or a bull🐮. Here we use the duplicate confirmations we used in bull traps, like a steady increase in trading volume and continuation candlestick patterns.

When a support zone is broken, hunters prepare to set traps. If the bearish momentum candle is not accompanied by increased trading volume, this can be a sign of a trap.

The ⚫️⚫️⚫️Three Black Crow⚫️⚫️⚫️ candlestick pattern is usually a reversal pattern but sometimes acts as a continuation pattern. If a high trading volume accompanies this pattern, it can be a valid sign of a breakout.

Now I will tell you how to use these traps (Bull&Bear) and get profit from them like a professional trader.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

How to trade with a Bull Trap

The bull traps start with an uptrend. As you can see the picture has a resistance zone, and the price may test a zone several times before passing it.

When a fake breakout occurs, it may initially be accompanied by an increase in trading volume, but it is entirely temporary, and you will notice a decrease⤵️ in the intensity of the trend from the next candles.

When the intensity of the trend decreases, market coyotes activate their traps. And they set sell orders, and the bloody🩸 candles appear on the chart.

With a valid breakout of the last support, the price reaches our entry point station⛽️. You can place your stop loss a little higher than the top of the bull trap and place your stop loss🚫 above the breakout candlestick of the support zone, considering the higher Risk-Reward ratio.

To find the take profit💰 point, consider the difference between the peak trap and the support zone as X, and Viola, now expects X amount to profit from your entry point.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

How to trade with a Bear Trap

Now it's time for the second trap.

After occurring a valid support zone breakout and an increase in price, you must wait for the price to break through the last resistance zone after a sudden sharp move.

When you can use the signs⚠️, you are sure that the coyotes have abandoned the process, that there is no trap🪤, and that real failure has happened; you can open your long positions.

Now, this passed resistance zone has turned into support, and you can wait for the price to test this area several times for more confidence and then open your entry point.

Like trading in bull traps, in bear traps, you can place your stop loss a little below the valley of the bear trap.

Considering the higher Risk-Reward ratio, you can also put it below the breakout candle of the resistance zone.

The take-profit point is the same as the bull trap, but vice versa. Consider X from the lowest price in the bear trap and the resistance zone.

Now, as much as X, we can expect that the upward trend will continue and precious dollars will rain on our heads.

Now that you have learned about the bull trap🪤 in an uptrend and the bear trap in a downtrend↘️, you should remember that the market is not always up🔺️ and down🔻, and the road runner should also expect traps on the range roads. You should be aware of bull/bear traps in the range market.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Range Market

When the price gets stuck between the support and resistance zones, the range market is created, and the coyotes also look for inexperienced road runners in this market.

This is a sad story for new traders who rush into positions when they see the resistance or support zone break.

Price fluctuations in range markets are minor; trading in a range market is much more complex than in bull and bear markets.

So I suggest you spend more time on your trading strategies and test them several times.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Conclusion:

Even in life, some coyotes seek to trick you by creating fake situations. But you have to be careful and smart like Road Runner.

Sir John Templeton believes that: "Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria."

And also, David Dreman says: "Bear markets are like avalanches: they start slowly and accelerate gradually before gaining momentum and becoming a force of nature🏞."

In the financial markets, bulls and bears are constantly fighting each other, but the real winners are always those who use various tools and indicators to avoid risk and find safe spots for trading and profit.

Once you practice and familiarize your eyes with all kinds of trends and traps, you will become a road runner in the market.

So, if you want to be like the clever road runner and avoid falling into the bull and bear traps in the financial markets, stay alert, stay informed, and be prepared to adapt your investment💰 strategy when necessary.

In future posts, we will take new steps in technical analysis and travel to the world of classic patterns. So follow the future posts and share your opinions and ideas in the comments. Your comments🎓 are precious to me.

Also, if you have friends👬👭 who are into classic cartoons🎆 and trading, send them this post.

👑Real & Accurcy Free & VIP Signals👉 t.me/ProTrader_365

📚Contact & Learning Technical Analysis 👉t.me/Ad_ProTrader365

📚Contact & Learning Technical Analysis 👉t.me/Ad_ProTrader365

Похожие публикации

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.