INVITE-ONLY SCRIPT

LevelUp^ Trend Follower All-In-One

Обновлено

LevelUp is an all-in-one collection of the most popular trend following tools merged into one indicator. LevelUp automates many aspects of technical analysis to find and highlight chart patterns and signals based on the principles of William O'Neil, Stan Weinstein, Jesse Livermore and other well-known trend followers.

The 10-EMA, 21-EMA and 50-SMA are foundational in LevelUp. LevelUp uses the term moving average alignment to refer to patterns that meet your specific requirements as it relates to moving averages and their relationship to price and one another. For example, you can request the start of MA alignment begin when the low is > 21-EMA, the 21-EMA is > 50-SMA and the 50-SMA is trending up.

LevelUp includes indicators for intraday, daily and weekly timeframes.

Key Features:

Daily Timeframe:

▪ Configure moving average alignment and preferred price action.

▪ Custom RS Line:

▪ Symbol overlays showing new RS highs.

▪ Custom moving average with optional cloud.

▪ View 10-week SMA on daily chart.

▪ Set exit criteria based on moving averages and % below entry.

▪ Stats table to simplify calculating entry/exit points.

▪ Signals table to quickly view if stock is trending up.

▪ Power trend tools and analysis.

Daily & Weekly Timeframe:

▪ Flat base detection with custom configuration.

▪ Consolidation detection with custom configuration.

▪ Highlight lower lows and lower closes (pullbacks).

▪ Highlight 52-week highs.

Weekly Timeframe:

▪ Customizable tight closes.

▪ Customizable up weeks.

Intraday Timeframe:

▪ View daily 10-EMA, 21-EMA and 50-SMA.

▪ 1-day and 2-day AVWAP.

▪ 5-day moving average.

All Timeframes:

▪ Marked highs/lows with lines showing support/resistance.

▪ Custom moving averages.

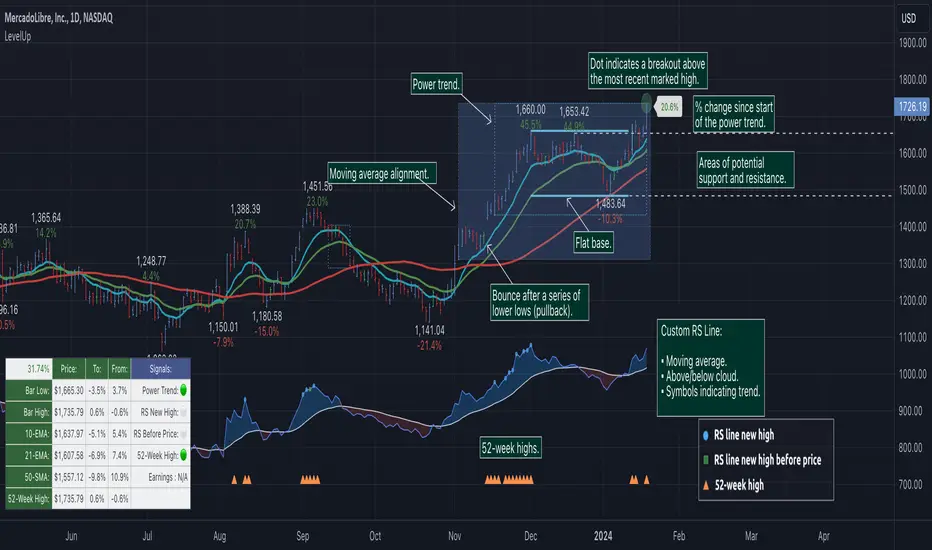

Daily Chart Examples

The following charts show a range of examples on customization and features in LevelUp when viewing a daily chart.

Weekly Chart Examples

Weekly charts are helpful for identifying longer-term trends and patterns. Trend followers often limit the number of indicators and signals on a weekly timeframe, making for a cleaner chart with less noise.

Intraday Chart Examples

Daily 10-EMA, 21-EMA and 50-SMA on an intraday chart.

AVWAP and marked highs/lows.

RS Line ~ Relative Strength

The RS Line compares a stock's performance to the S&P 500 index. A rising RS Line means the stock is outperforming the overall market. Another important signal is when the RS Line reaches a new high before price. When this occurs, it indicates strong demand for the stock and may precede a significant price increase as buyers accumulate shares. Both signals are customizable within LevelUp providing multiple visual cues when the required conditions are met.

LevelUp also adds a few unique visuals as it relates to the typical RS Line. Included are options to show symbols on the RS line that represent RS Line new high and RS Line new high before price. This provides an at-a-glance view of the trend. Additionally, LevelUp allows for custom moving averages to be applied to the RS Line as well as an optional cloud to help identify support/resistance levels.

Power Trends

When a power trend is active, there is a stronger than usual uptrend underway. The concept of a power trend was created by Investor's Business Daily (IBD) based on extensive backtesting and historical analysis.

A power trend by definition uses a major index, such as the Nasdaq Composite (IXIC), as the data source for determining a power trend's state, either off or on. The LevelUp indicator builds upon this concept by allowing the current active chart symbol to be the data source for the power trend.

What Starts A Power Trend:

▪ Low is above the 21-day EMA for at least 10 days.

▪ 21-day EMA is above the 50-day SMA for at least five days.

▪ 50-day SMA is in an uptrend.

▪ Close up for the day.

What Ends A Power Trend:

▪ 21-day EMA crosses under 50-day SMA and the close is below prior day close.

▪ Close below the 50-day SMA and low is 10% below recent high.

Important Note: The power trend as created by IBD uses the daily 21-EMA and 50-SMA. Hence, the power trend is only shown when on the daily timeframe.

AVWAP - Anchored VWAP

The Anchored Volume Weighted Average Price (AVWAP), created by Brian Shannon, is used to assess the average price at which an asset has traded since a specific time, event or milestone. This could be the beginning of a trading day, the release of important news, or any other event deemed significant. By anchoring the VWAP to a specific point in time, it helps market participants analyze how prices have evolved relative to that anchor.

If a stock is above a rising AVWAP, buyers are in control, while a declining AVWAP indicates sellers are in control. By analyzing AVWAP, traders can make informed decisions on timing entries, managing losses and profits, or deciding to stay on the sidelines during periods of market indecision.

Tight Weeks And Up Weeks

William O'Neil primarily focused on weekly charts. Two common patterns he looked for were tight weeks and up weeks.

Tight weeks occur when there are small variations in price from one week to the next. This indicates a lack of supply and accumulation by institutions. You can configure the minimum number of weeks and the maximum % change in price from week to week.

Up weeks are defined as multiple weeks where each close is higher than the previous week. This pattern is often a signal of institutional buying. At a minimum, O'Neil looked for three weeks of upward price action. You can configure the minimum number of up weeks required.

Flat Base

A flat based is relatively tight price action within a range. A flat base takes 5+ weeks (25+ days) to form. Although flat bases are often found after a more significant advance in price, this isn't always the case. With that in mind, LevelUp does not currently have requirements for a prior uptrend while scanning for flat bases.

In a flat base, price declines should be no more than 15% from intraday peak to trough. This is an important distinction, as with a consolidation (see below) the maximum depth is based on the high of first bar that started the base.

Default Requirements:

▪ Daily minimum length: 25 days.

▪ Weekly minimum length: 5 weeks.

▪ Depth maximum: 15% (daily or weekly).

Consolidation

A consolidation differs from a flat base in that the former can be much deeper and last longer. In addition, the fluctuations in price of a flat base are often tighter than a consolidation.

Unlike a flat base, the maximum depth is calculated from the high at the start of the consolidation. The minimum length and maximum depth can be customized for all flat base and consolidation patterns.

Default Requirements:

▪ Daily minimum length: 30 days.

▪ Weekly minimum length: 6 weeks.

▪ Depth maximum: 35% (daily or weekly).

Pullback In Price And Potential Bounce

A pullback occurs when the price declines after an initial advance. This is normal price action as prior support levels are tested. Pullbacks also act as a way to shakeout weak holders before the primary trend resumes.

With LevelUp you specify the type of pullback to track: lower lows, lower closes or both. You also set the minimum number of bars required. Different values can be set for daily and weekly charts. Once your requirements are met, LevelUp will highlight the bar after the pullback is complete. This is often a potential entry/add point.

52-Week Highs

A 52-week high refers to the highest closing price within the past 52 weeks. Trend followers often use the 52-week high as a signal to identify assets with upward momentum, considering it as an indication of a potential trend continuation. This approach assumes that assets that have reached a 52-week high are more likely to experience further price appreciation.

52-week highs can be shown on both weekly and daily charts. You can set the location where the 52-week high symbol is shown: above the bar, below the bar, at the top of the chart or at the bottom of the chart.

Marked Highs And Lows

Marked highs/lows, often referred to as pivot highs/lows, can be helpful to find areas of potential support and resistance. As defined by William O'Neil, on a daily chart, a marked high is the highest high going back nine bars and forward nine bars. The number of days forward/backward is referred to as the period. The same concept applies to finding marked lows.

One benefit of LevelUp marked highs/lows is that you can customize the high and low periods on all timeframes.

There is an additional option when viewing marked highs/lows to see where a breakout occurs. The highlight is shown if the current bar high is above the most recent pivot high.

Comparing Stock Performance

With two or more copies of LevelUp installed, you can configure different settings and compare and contrast how indicators and signals perform relative to one another.

This is a great way to come up with your own custom layout for each timeframe, tailored to your preferences and trading style.

Stats And The Signals Table

The stats and signal tables can be very helpful to see price information and patterns at a glance. For example, you can quickly determine potential stoploss placement based on the distance to/from a moving average. The signals tables show the status of several key trend indicators, including 52-week highs, RS Line new high and RS Line new high before price.

Managing Long Term Trends

Depending on your trading style, there are many ways to take advantage of long term trends. For example, the chart that follows show how an uptrend can be a profitable trade whether holding for the duration or taking shorter term trades along the way.

The 10-EMA, 21-EMA and 50-SMA are foundational in LevelUp. LevelUp uses the term moving average alignment to refer to patterns that meet your specific requirements as it relates to moving averages and their relationship to price and one another. For example, you can request the start of MA alignment begin when the low is > 21-EMA, the 21-EMA is > 50-SMA and the 50-SMA is trending up.

LevelUp includes indicators for intraday, daily and weekly timeframes.

Key Features:

Daily Timeframe:

▪ Configure moving average alignment and preferred price action.

▪ Custom RS Line:

▪ Symbol overlays showing new RS highs.

▪ Custom moving average with optional cloud.

▪ View 10-week SMA on daily chart.

▪ Set exit criteria based on moving averages and % below entry.

▪ Stats table to simplify calculating entry/exit points.

▪ Signals table to quickly view if stock is trending up.

▪ Power trend tools and analysis.

Daily & Weekly Timeframe:

▪ Flat base detection with custom configuration.

▪ Consolidation detection with custom configuration.

▪ Highlight lower lows and lower closes (pullbacks).

▪ Highlight 52-week highs.

Weekly Timeframe:

▪ Customizable tight closes.

▪ Customizable up weeks.

Intraday Timeframe:

▪ View daily 10-EMA, 21-EMA and 50-SMA.

▪ 1-day and 2-day AVWAP.

▪ 5-day moving average.

All Timeframes:

▪ Marked highs/lows with lines showing support/resistance.

▪ Custom moving averages.

Daily Chart Examples

The following charts show a range of examples on customization and features in LevelUp when viewing a daily chart.

Weekly Chart Examples

Weekly charts are helpful for identifying longer-term trends and patterns. Trend followers often limit the number of indicators and signals on a weekly timeframe, making for a cleaner chart with less noise.

Intraday Chart Examples

Daily 10-EMA, 21-EMA and 50-SMA on an intraday chart.

AVWAP and marked highs/lows.

RS Line ~ Relative Strength

The RS Line compares a stock's performance to the S&P 500 index. A rising RS Line means the stock is outperforming the overall market. Another important signal is when the RS Line reaches a new high before price. When this occurs, it indicates strong demand for the stock and may precede a significant price increase as buyers accumulate shares. Both signals are customizable within LevelUp providing multiple visual cues when the required conditions are met.

LevelUp also adds a few unique visuals as it relates to the typical RS Line. Included are options to show symbols on the RS line that represent RS Line new high and RS Line new high before price. This provides an at-a-glance view of the trend. Additionally, LevelUp allows for custom moving averages to be applied to the RS Line as well as an optional cloud to help identify support/resistance levels.

Power Trends

When a power trend is active, there is a stronger than usual uptrend underway. The concept of a power trend was created by Investor's Business Daily (IBD) based on extensive backtesting and historical analysis.

A power trend by definition uses a major index, such as the Nasdaq Composite (IXIC), as the data source for determining a power trend's state, either off or on. The LevelUp indicator builds upon this concept by allowing the current active chart symbol to be the data source for the power trend.

What Starts A Power Trend:

▪ Low is above the 21-day EMA for at least 10 days.

▪ 21-day EMA is above the 50-day SMA for at least five days.

▪ 50-day SMA is in an uptrend.

▪ Close up for the day.

What Ends A Power Trend:

▪ 21-day EMA crosses under 50-day SMA and the close is below prior day close.

▪ Close below the 50-day SMA and low is 10% below recent high.

Important Note: The power trend as created by IBD uses the daily 21-EMA and 50-SMA. Hence, the power trend is only shown when on the daily timeframe.

AVWAP - Anchored VWAP

The Anchored Volume Weighted Average Price (AVWAP), created by Brian Shannon, is used to assess the average price at which an asset has traded since a specific time, event or milestone. This could be the beginning of a trading day, the release of important news, or any other event deemed significant. By anchoring the VWAP to a specific point in time, it helps market participants analyze how prices have evolved relative to that anchor.

If a stock is above a rising AVWAP, buyers are in control, while a declining AVWAP indicates sellers are in control. By analyzing AVWAP, traders can make informed decisions on timing entries, managing losses and profits, or deciding to stay on the sidelines during periods of market indecision.

Tight Weeks And Up Weeks

William O'Neil primarily focused on weekly charts. Two common patterns he looked for were tight weeks and up weeks.

Tight weeks occur when there are small variations in price from one week to the next. This indicates a lack of supply and accumulation by institutions. You can configure the minimum number of weeks and the maximum % change in price from week to week.

Up weeks are defined as multiple weeks where each close is higher than the previous week. This pattern is often a signal of institutional buying. At a minimum, O'Neil looked for three weeks of upward price action. You can configure the minimum number of up weeks required.

Flat Base

A flat based is relatively tight price action within a range. A flat base takes 5+ weeks (25+ days) to form. Although flat bases are often found after a more significant advance in price, this isn't always the case. With that in mind, LevelUp does not currently have requirements for a prior uptrend while scanning for flat bases.

In a flat base, price declines should be no more than 15% from intraday peak to trough. This is an important distinction, as with a consolidation (see below) the maximum depth is based on the high of first bar that started the base.

Default Requirements:

▪ Daily minimum length: 25 days.

▪ Weekly minimum length: 5 weeks.

▪ Depth maximum: 15% (daily or weekly).

Consolidation

A consolidation differs from a flat base in that the former can be much deeper and last longer. In addition, the fluctuations in price of a flat base are often tighter than a consolidation.

Unlike a flat base, the maximum depth is calculated from the high at the start of the consolidation. The minimum length and maximum depth can be customized for all flat base and consolidation patterns.

Default Requirements:

▪ Daily minimum length: 30 days.

▪ Weekly minimum length: 6 weeks.

▪ Depth maximum: 35% (daily or weekly).

Pullback In Price And Potential Bounce

A pullback occurs when the price declines after an initial advance. This is normal price action as prior support levels are tested. Pullbacks also act as a way to shakeout weak holders before the primary trend resumes.

With LevelUp you specify the type of pullback to track: lower lows, lower closes or both. You also set the minimum number of bars required. Different values can be set for daily and weekly charts. Once your requirements are met, LevelUp will highlight the bar after the pullback is complete. This is often a potential entry/add point.

52-Week Highs

A 52-week high refers to the highest closing price within the past 52 weeks. Trend followers often use the 52-week high as a signal to identify assets with upward momentum, considering it as an indication of a potential trend continuation. This approach assumes that assets that have reached a 52-week high are more likely to experience further price appreciation.

52-week highs can be shown on both weekly and daily charts. You can set the location where the 52-week high symbol is shown: above the bar, below the bar, at the top of the chart or at the bottom of the chart.

Marked Highs And Lows

Marked highs/lows, often referred to as pivot highs/lows, can be helpful to find areas of potential support and resistance. As defined by William O'Neil, on a daily chart, a marked high is the highest high going back nine bars and forward nine bars. The number of days forward/backward is referred to as the period. The same concept applies to finding marked lows.

One benefit of LevelUp marked highs/lows is that you can customize the high and low periods on all timeframes.

There is an additional option when viewing marked highs/lows to see where a breakout occurs. The highlight is shown if the current bar high is above the most recent pivot high.

Comparing Stock Performance

With two or more copies of LevelUp installed, you can configure different settings and compare and contrast how indicators and signals perform relative to one another.

This is a great way to come up with your own custom layout for each timeframe, tailored to your preferences and trading style.

Stats And The Signals Table

The stats and signal tables can be very helpful to see price information and patterns at a glance. For example, you can quickly determine potential stoploss placement based on the distance to/from a moving average. The signals tables show the status of several key trend indicators, including 52-week highs, RS Line new high and RS Line new high before price.

Managing Long Term Trends

Depending on your trading style, there are many ways to take advantage of long term trends. For example, the chart that follows show how an uptrend can be a profitable trade whether holding for the duration or taking shorter term trades along the way.

Информация о релизе

Version 1.2New Features:

▪ Custom alerts on moving average alignment.

▪ Custom alerts on a power trend.

▪ Show all-time highs on daily and weekly timeframes.

Updates:

▪ In Settings, minor changes for clarity and organization.

▪ Add descriptions to plots and fills allowing for customizations in Settings and alerts.

Информация о релизе

Version 1.4Updates:

▪ Minor change to AVWAP and support for indexes.

▪ Week-to-date UI update.

▪ Version number is now shown after the indicator name.

Информация о релизе

Version 1.6New Features:

▪ AVWAP support for exchanges around the globe, respecting trading days/hours.

▪ Daily moving averages on intraday charts have an option to show/hide price.

Updates:

▪ 52-week high and all-time high calculation updates.

Информация о релизе

Version 1.8Complete redesign of the auto-anchored VWAP (AVWAP) to provide additional features and functionality.

What's New:

▪ Support for global exchanges, respecting holidays and trading days/hours.

▪ Review charts with auto-anchors in place after trading hours as well as on weekends and holidays.

▪ Support for extended sessions, both pre-market and after-hours.

▪ Replay feature is now available. This highly requested feature is unique to the LevelUp indicator.

▪ Support for futures and forex.

▪ Custom alerts for 1-day, 2-day and week-to-date AVWAPs.

Информация о релизе

Version 1.9Additional updates to the auto-anchored VWAP (AVWAP) on intraday charts.

What's New:

▪ 2-day AVWAP remains anchored to the prior trading day, even over weekends and holidays.

▪ Additional support for TradingView replay.

▪ Optimized code for calculating AVWAP to improve performance.

Информация о релизе

Version 2.0Major update to Moving Average Alignment™ (MAA) providing customization options of all moving averages that are used to determine MAA start and end points.

Whether you are a swing or position trader, you can now configure the MAA to better align with your preferred trading style and risk management process.

What's New:

▪ Customize moving averages for Moving Average Alignment™.

Updates:

▪ Alerts options are now sorted and grouped based on the alert type.

▪ Changes to calculation for 52-week high on weekly charts.

Информация о релизе

Version 2.1What's New:

▪ Option to smooth daily moving averages on intraday timeframes and weekly moving average on daily timeframe.

▪ Moving averages for lower timeframes are now managed in a separate section in Settings.

▪ Active power trend can be highlighted by a customizable symbol along the bottom of the chart.

Информация о релизе

Version 2.3 What's New:

▪ Custom options to set the Moving Average Alignment anchor point.

▪ More accurate percent change calculations.

▪ Hover over percent change values for information on why Moving Average Alignment ended.

▪ Reduce noise on the chart by hiding Moving Average Alignment boxes.

Updates:

▪ Change weekly moving average calculations when shown on the daily timeframe.

Информация о релизе

Version 2.4What's New:

▪ Option to require MA 1 and/or MA 2 to be in an uptrend for Moving Average Alignment.

▪ Updated the messages shown when hovering over percent change labels.

Информация о релизе

Version 2.6What's New:

▪ Updated calculations and processing of fractional values for the RS Line.

▪ More accurate determination of RS Line at New Highs and RS Line at New Highs Before Price.

Информация о релизе

Version 2.7What's New:

▪ The Signals table will now show RS status even if the RS Line is not visible on the chart.

▪ Performance improvements.

Информация о релизе

Version 2.8What's New:

▪ View earnings and sales acceleration in the Signals table. 🚀

▪ Stats and Signal data are now in separate tables allowing for more customization.

▪ Moving Average Alignment option to require MA 3 (50-SMA by default) to be in an uptrend.

Earnings and Sales Acceleration

Информация о релизе

Version 2.9What's New:

▪ Earnings and sales acceleration are now calculated using the percent change QoQ.

▪ Hover over EPS or Sales to view earning & sales data as well as percent change.

View Earnings, Sales and Percent Change

Информация о релизе

Version 3.0What's New:

▪ Most requested Power Trend feature: view progress towards the next Power Trend. 🚀

▪ Additional options to show an active Power Trend.

View Progress Towards the Next Power Trend

Скрипт с ограниченным доступом

Доступ к этому скрипту разрешён только для пользователей, авторизованных автором, и для этого обычно требуется оплата. Вы можете добавить скрипт в список избранных, но использовать его можно будет только после запроса на доступ и получения разрешения от автора. Свяжитесь с JohnMuchow, чтобы узнать больше, или следуйте инструкциям автора ниже.

TradingView не советует платить за скрипт и использовать его, если вы на 100% не доверяете его автору и не понимаете, как он работает. Часто вы можете найти хорошую альтернативу с открытым исходным кодом бесплатно в нашем разделе Скрипты сообщества.

Инструкции от автора

″LevelUp Your Trading ~ Professional TradingView® Indicators: https://LevelUpTools.net

Хотите использовать этот скрипт на графике?

Внимание: прочтите это перед тем, как запросить доступ.

LevelUp Your Trading ~ Professional TradingView® Indicators: LevelUpTools.net

Buy Me A Beer: leveluptools.gumroad.com/coffee

Thanks for your support! 🍻

Buy Me A Beer: leveluptools.gumroad.com/coffee

Thanks for your support! 🍻

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.